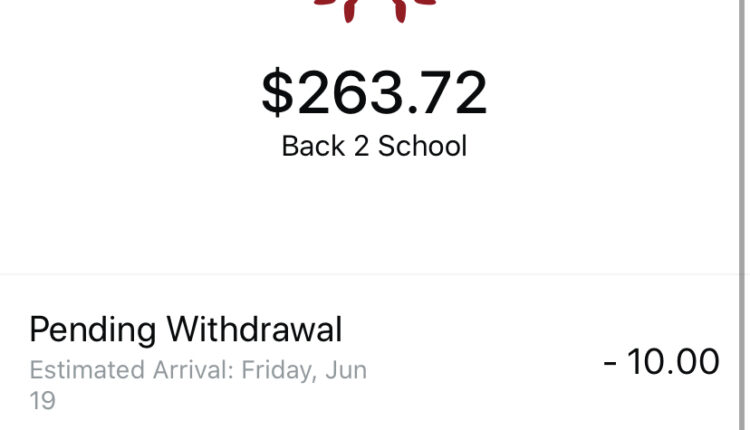

Once a save to Digit or withdrawal back to your bank account is confirmed, there, is no way to cancel it at this time.

How do I get my money back from Digit?

How will I get my money back? After you close your account with Digit, your saved funds will be automatically returned to your linked bank account electronically the next business day. You can request a check for your savings if your bank account has since closed.

How do you cancel a pending transaction on digits?

While the funds are in the pending state, they cannot be canceled or edited.

How long does it take for Digit to withdrawal?

How long does it take to get money back into my bank account from Digit? Digit offers Instant withdrawals back to your bank account for an additional $. 99. Instant withdrawals arrive in a matter of minutes.

How long does it take Digit to transfer?

Now, Digit, a popular automated savings app, announced Tuesday a solution: it is starting to let users transfer their savings into their checking accounts within minutes. For 99 cents per withdrawal, users can move money from their Digit account into another bank account within 30 minutes.

How do you reverse a scammed money?

Contact your bank immediately to let them know what’s happened and ask if you can get a refund. Most banks should reimburse you if you’ve transferred money to someone because of a scam. This type of scam is known as an ‘authorised push payment’.

Does Digit take money from your account?

However, saving money with Digit isn’t free. The app charges a monthly subscription fee of $5. And if you want to instantly withdraw money from your Digit account to your checking account, the app imposes a fee of 99 cents, though you can choose to wait a day or two and pay nothing for the withdrawal.

Can the transaction be reversed if it is pending?

A pending transaction can be released or reversed at any time if the merchant submits a request to the Bank.

Can you stop a processing transaction?

Disputing a pending transaction The issuer cannot cancel or alter the transaction until it’s been finalized. If you need to cancel the transaction before then, you’ll have to contact the merchant who placed the charge. You can ask them to contact your card issuer and reverse the transaction depending on the situation.

How long until a pending transaction is Cancelled?

How long does it take for a pending transaction to clear? Most pending transactions clear in a day or two, but some may take up to a week. At 5 days you may want to contact your bank or the merchant if you don’t know why it would still be pending.

Is Digit worth the money?

If you’re looking for a budgeting app solely focused on saving money, paying down debt and investing concurrently, Digit is a great budgeting app to consider. Even with its monthly fee, the app may be worth it relieve the chore of manually saving each month and making investment decisions.

How much money does Digit take out?

Digit charges a $5 monthly fee after a 30-day free trial. The monthly fee is deducted from the checking account that you link to the app. It’s charged as long as your account is active, including if you’ve paused your savings.

Is Digit a good bank?

Digit is legit. They keep your money and personal info safe and offer a valuable service that will benefit many people. It’s a great option for people who have a hard time saving money. There is a $5 monthly fee attached to using Digit so be sure to weight if the investment is worth using their service to save money.

What banks Does Digit support?

Currently, Digit primarily operates by having users link their external checking account, such as a Bank of America or Wells Fargo account, to the app.

What is Digit rainy day?

Your Rainy Day Fund within Digit is for exactly that: a rainy day. Digit saves for this fund by default for every Digit user to help you build up an emergency fund or for life’s little surprises.

How do I contact Digit?

Contact Digit Support Get in touch with our Support Team with questions and concerns, or submit a complaint by sending us a message or emailing help@digit.co. We’re available Monday – Friday, 9 AM – 5 PM PST with limited support on weekends and holidays. We look forward to hearing from you!

Can Digit be trusted?

Digit is legit. They keep your money and personal info safe and offer a valuable service that will benefit many people. It’s a great option for people who have a hard time saving money. There is a $5 monthly fee attached to using Digit so be sure to weight if the investment is worth using their service to save money.

Will the bank return your money if you get scammed?

Banks and credit card companies usually reimburse stolen money, but they don’t always have to. If you lose a debit card or have it stolen and don’t report the fraud right away, it’s possible your bank won’t refund stolen money and you could be liable for some of the losses.

Can scammed money be recovered?

Report the scam to your bank’s fraud team – the first step if for you to report the issue to your bank’s fraud team. This will kick off an investigation at the bank. Fraud investigation – your bank has 15 days to investigate and then report back with an outcome on whether it will give you money back.

Is Digit a safe way to save money?

It’s a legitimate way to save money in an FDIC-insured account without having to keep track of a monthly transfer amount or worry about overdraft fees. Because Digit analyzes your spending habits to decide how much to save for you, it saves you time and energy and helps you avoid mistakes.

Does Digit save or invest your money?

Digit budgets, saves, and invests for you Our mission is to make financial health effortless, so we designed a smart bank account that constantly guides your money in the right direction. Digit plans for today, tomorrow, and way, way later by making spending, bills, savings, and investments all work together.

Can I tell my bank to stop a transaction?

Give your bank a “stop payment order” Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a “stop payment order” . This instructs your bank to stop allowing the company to take payments from your account.