Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it’s not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

How long do I have to wait for funds to be available?

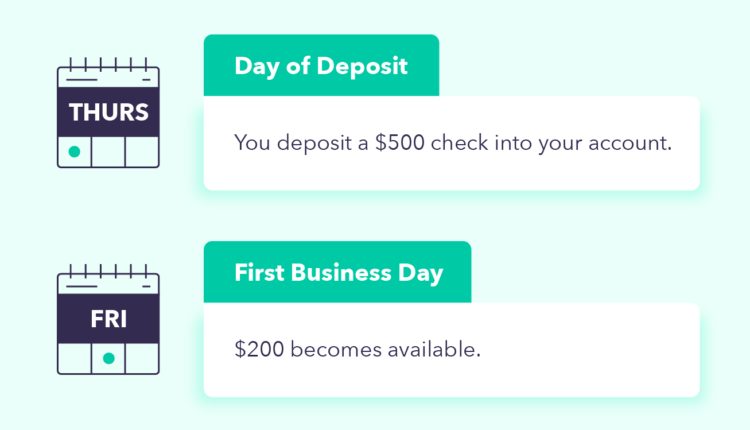

Most of the time, when you deposit a check, a portion of the funds is made available to your account on the same day, with the remainder becoming available on the next business day. 1 Sometimes there are circumstances that cause a check deposit to be placed on a temporary hold of up to seven business days.

Why does it take so long for funds to be available?

The duration of a bank transfer to be successfully made often depends on a number of factors, due to which your transaction can be delayed. This includes the timing of the transfer, where the transfer is being made, the currencies involved, security checks, bank holidays, and the reasons for the transaction.

What does it mean when it says funds will be available?

What Are Available Funds? Available funds are money in a bank account that is accessible for immediate use. In other words, it represents the total amount of capital that can be withdrawn at an automated teller machine (ATM), used to make purchases with a debit card, write a check, transfer money and pay bills.

Why do banks take 3 days to clear funds?

The online banking industry has a “three-day good funds model” policy; where transfers will typically take between two and four days. The banks want to be sure the money is really there and available before it lets the receiver use the money – this is why they don’t make the funds available immediately.

What time do banks release funds?

Funds deposited before 9:00 p.m. ET on a business day will generally be available the next business day. Funds deposited before 8:00 p.m. PT on a business day will generally be available the next business day. You will be notified if a hold is placed on any deposited funds.

Can I use available funds that are pending?

No, pending deposits are not available for use until they have been authorized by the bank and added to your available balance. In most cases, a deposit will clear and become available for use within 1-3 business days.

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it’s not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

What happens when you deposit over $10000 check?

The Law Behind Bank Deposits Over $10,000 It states that banks must report any deposits (and withdrawals, for that matter) that they receive over $10,000 to the Internal Revenue Service. For this, they’ll fill out IRS Form 8300.

What time of day does money clear in banks?

Most banks do that in the morning, but there are some that update accounts after midnight. If you’re unsure how your bank operates, you can always check its website or contact its customer service team.

Can I use money if it says available balance?

Your available balance is the amount of money in your account, minus any credits or debts that have not fully posted to the account yet. This is the amount of money you can spend, but it may fully reflect the money you have at your disposal.

Can I spend my available balance?

Your account balance is made up of all posted credit and debit transactions. It’s the amount you have in the account before any pending charges are added. Your available balance is the amount you can use for purchases or withdrawals.

How do I get a pending deposit release?

Can you withdraw a pending direct deposit? No, a pending direct deposit is not able to be withdrawn as the deposit is still in the process of being verified by your bank. Once the deposit is authorized, you’ll then be able to use these funds, including to withdraw them.

Do banks get suspicious of cash deposits?

Banks report individuals who deposit $10,000 or more in cash. The IRS typically shares suspicious deposit or withdrawal activity with local and state authorities, Castaneda says. The federal law extends to businesses that receive funds to purchase more expensive items, such as cars, homes or other big amenities.

How long does a bank hold a check over $5000?

Banks may currently decide to place six types of holds on checks: Any amount exceeding a $5,000 deposit may be held. This “remainder” must be made available within a reasonable time, usually two to five business days. Such deposits are considered large deposits.

What is the fastest way for a check to clear?

The fastest way to have access to check funds is to deposit the check in person at a bank or credit union branch. That ensures the deposit is made before the bank’s cut-off time, which speeds up the process. Mobile check deposits and those made at ATMs after hours typically take longer to clear.

How much cash deposit is suspicious?

The $10,000 Rule Ever wondered how much cash deposit is suspicious? The Rule, as created by the Bank Secrecy Act, declares that any individual or business receiving more than $10 000 in a single or multiple cash transactions is legally obligated to report this to the Internal Revenue Service (IRS).

How much money can I deposit without being flagged?

The IRS requires banks and businesses to file Form 8300, the Currency Transaction Report, if they receive cash payments over $10,000. Depositing more than $10,000 will not result in immediate questioning from authorities, however. The report is done simply to help prevent fraud and money laundering.

Is it suspicious to deposit a large check?

Suspicious Activities: Even if your deposits don’t exceed the $10,000 threshold, your bank could still consider them worthy of reporting. The IRS requests financial institutions to watch for suspicious activity, which could mean large transactions or series of similar deposits over time.

What time of night does money clear?

A night cycle, created in 1979, is used to process Automated Clearing House (ACH) transfers (debits and credits) at night—generally between 10:00 p.m. and 1:30 a.m. Eastern Standard Time (EST). The ACH is a nationwide system for transferring money electronically that is sometimes referred to as the “nighttime window.”

Can money go into your bank on a Saturday?

Funds can be transferred almost immediately and usually within a couple of hours, rather than days. Banks and building societies operating the Faster Payments service can process payments and transfers 24 hours a day, any day of the week, including weekends and Bank Holidays.

Why is my money in my balance but not available?

The current balance on your bank account is the total amount of money in the account. But that doesn’t mean it’s all available to spend. Some of the funds included in your current balance may be from deposits you made or checks you wrote that haven’t cleared yet, in which case they’re not available for you to use.