Up to two business days for on-us checks (meaning checks drawn against an account at the same bank) Up to five additional business days (totaling seven) for local checks. Longer hold periods, when the financial institution can prove a lengthier hold is reasonable.

What time do banks release funds?

Funds deposited before 9:00 p.m. ET on a business day will generally be available the next business day. Funds deposited before 8:00 p.m. PT on a business day will generally be available the next business day. You will be notified if a hold is placed on any deposited funds.

How long can bank hold funds?

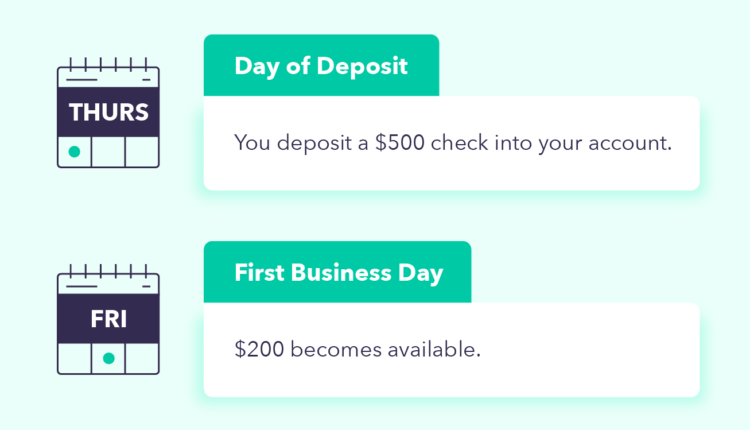

Most of the time, when you deposit a check, a portion of the funds is made available to your account on the same day, with the remainder becoming available on the next business day. 1 Sometimes there are circumstances that cause a check deposit to be placed on a temporary hold of up to seven business days.

How long does it take for bank funds to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it’s not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

How long before funds are released?

The timeframe for releasing mortgage funds does vary from lender to lender. However, it is common for funds to be released between 3 and 7 days.

How long does it take for bank funds to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it’s not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

Why do banks take so long to release funds?

The online banking industry has a “three-day good funds model” policy; where transfers will typically take between two and four days. The banks want to be sure the money is really there and available before it lets the receiver use the money – this is why they don’t make the funds available immediately.

Why do bank funds take so long to release?

Three Day Good Funds Model The receiving banks often take 2-4 days for funds to be released to customers because they are following what they call the “”three-day good funds model”, which basically means they’ll hold the funds for three days to make sure it’s not a fraudulent transaction.

Can bank release funds on hold?

Federal regulations allow banks to hold deposited funds for a set period, meaning you can’t tap into that money until after the hold is lifted. But the bank can’t keep your money on hold indefinitely.

Can banks refuse to give you your money?

refuse to cash my check? There is no federal law that requires a bank to cash a check, even a government check. Some banks only cash checks if you have an account at the bank. Other banks will cash checks for non-customers, but they may charge a fee.

Can banks release a hold?

Contact Your Bank You can ask your bank to provide an explanation for the hold or sometimes even to release the hold. In most cases, you won’t be able to do anything about the hold though, and because all banks have them, you can’t switch banks to avoid them either.

How can I make my funds clear faster?

The fastest way to have access to check funds is to deposit the check in person at a bank or credit union branch. That ensures the deposit is made before the bank’s cut-off time, which speeds up the process. Mobile check deposits and those made at ATMs after hours typically take longer to clear.

How long does a 5000 check take to clear?

Deposits of $5,000 or less usually clear within 3 business days. Deposits of more than $5,000 usually take 4 business days to clear.

Can pending funds be released early?

No, a pending direct deposit is not able to be withdrawn as the deposit is still in the process of being verified by your bank. Once the deposit is authorized, you’ll then be able to use these funds, including to withdraw them. What is this?

Can a bank hold your money for 10 days?

The bank usually puts a blanket hold in place that may potentially last up to 5-10 business days. 67 You can call the bank after a few days to see if the money has been collected and if the bank will release the hold early. Be sure to speak to a representative and not refer to the balance shown on an ATM statement.

What’s the longest a bank can hold your check?

The Federal Reserve requires that a bank hold most checks before crediting the customer’s account for no longer than a “reasonable period of time,” which is regarded as two business days for a same-bank check and up to six business days for one drawn on a different bank.

How long does a bank hold a check over $5000?

For any checks deposits over $5,000, the first $5,000 will be available on the second business day, and any leftover amount will be available on the seventh business day or later.

How long does a bank hold a check over $10000?

Essentially, any transaction you make exceeding $10,000 requires your bank or credit union to report it to the government within 15 days of receiving it — not because they’re necessarily wary of you, but because large amounts of money changing hands could indicate possible illegal activity.

How long does it take for bank funds to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it’s not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

Can the bank release funds early?

The amount of time a bank or credit union holds funds you deposit by check is sometimes referred to as a “deposit hold” or “check hold”. Some banks or credit unions may make funds available more quickly than the law requires, and some may expedite funds availability for a fee.

Can I sue a bank for holding my money?

Holding your money and not giving it back when you ask isn’t exactly fair. In California, the Unfair Competition Law also lets you sue to stop unfair business practices. And in Texas, the Deceptive Trade Practices Act does the same. Most states have similar laws.

How can I get bank to release hold?

When figuring out how to remove a hold on a bank account, you can often contact your bank and find out what caused the hold. If it was a pre-authorization hold placed by a merchant on a debit card transaction, you might be able to contact them directly and have them remove it.