What Is Profit-Taking? Profit-taking is the act of selling a security in order to lock in gains after it has risen appreciably. While the process benefits the investor taking the profits, it can hurt other investors by sending shares of their investment lower, without notice.

How do you take profits?

What Is Profit-Taking? Profit-taking is the act of selling a security in order to lock in gains after it has risen appreciably. While the process benefits the investor taking the profits, it can hurt other investors by sending shares of their investment lower, without notice.

What does it mean to take profit?

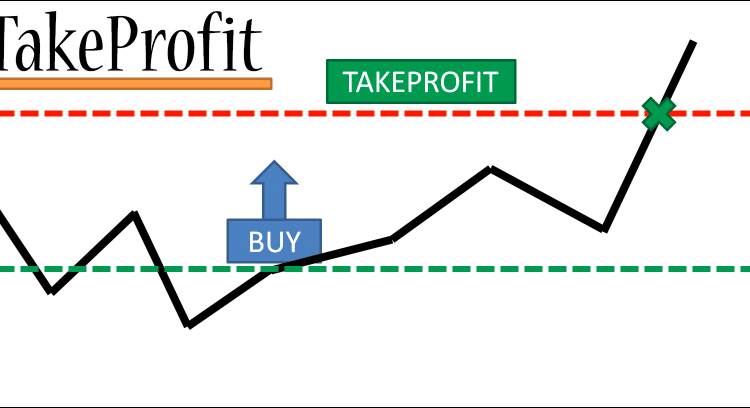

A Take Profit (TP) is an instruction to close a trade at a specific rate if the market rises, to ensure your profit is realized and goes to your available balance. Note, take profit orders are not available on stocks in the US. Take Profit instructions are optional and you can set it once your trade is already open.

How do you know when to take profits?

How do you know where to take profit?

One of the simplest tactics for establishing a profit target is to use a fixed reward:risk ratio. Based on your entry point, it will require your stop-loss level. This stop-loss will determine how much you are risking on the trade. The profit target is set at a multiple of this, for example, 2:1.

What does it mean to take profit?

A Take Profit (TP) is an instruction to close a trade at a specific rate if the market rises, to ensure your profit is realized and goes to your available balance. Note, take profit orders are not available on stocks in the US. Take Profit instructions are optional and you can set it once your trade is already open.

What is the best take profit strategy?

How do you set a take profit price?

The order conventions are similar to a limit orders. For a buy take profit, you would set the profit price below the market price. For a sell take profit, you set the profit price above the market price. If these conventions are not followed, the order will execute immediately.

Why is taking profits important?

Taking profit is a key element of trading success because it is the only moment when a trader actually realizes a profit. Any floating or paper profit from an open trade means nothing until the trade is closed and booked.

What happens when you set a take profit?

A take-profit order (T/P) is a type of limit order that specifies the exact price at which to close out an open position for a profit. If the price of the security does not reach the limit price, the take-profit order does not get filled.

What is the 8 week hold rule?

What percentage of profit should I keep?

What is the best stop loss and take profit?

Although there is no general way of structuring your stop loss and take profit orders, most traders try to have a 1:2 risk/reward ratio. For instance, if you are willing to risk 1% of your investment, then you can target a 2% profit per trade.

How many pips is a good profit?

However, most experts agree that between 1 to 10 pips per day is a reasonable goal for most traders. As for trading 0.05 lots per every 100 dollars capital, this is generally considered to be a safe amount. This is because it allows for proper risk management while still providing a good opportunity for profit.

How do you trade and take profits?

Take Profit is abbreviated as (T/P). For example, a trader goes long (in other words, enters a buy position) by entering the market at 1.2980, expecting prices to rally higher. He wants to benefit from the rise, so he places a Take Profit order at a level higher than the entry price, say 1.3180.

How do you take profits in Crypto?

For example, if you purchase Bitcoin at $31,710 and have a profit target of two percent, you would place an order to sell at $32,344. If the price of Bitcoin reaches this target level, the trade is closed. In a nutshell, that’s how to take crypto profits with price targets.

What happens when you set a take profit?

A take-profit order (T/P) is a type of limit order that specifies the exact price at which to close out an open position for a profit. If the price of the security does not reach the limit price, the take-profit order does not get filled.

What does it mean to take profit?

A Take Profit (TP) is an instruction to close a trade at a specific rate if the market rises, to ensure your profit is realized and goes to your available balance. Note, take profit orders are not available on stocks in the US. Take Profit instructions are optional and you can set it once your trade is already open.

At what percentage profit should you sell a stock?

When should I sell my shares for profit?

What is the best strategy for 1 minute trading?

One of the most popular 1 minute scalping strategies is known as trend-following. Its name tells it all. It is a trading strategy that identifies an already-established trend and then follows it until it changes its direction.

How do you take profit from a trade?

Take Profit is abbreviated as (T/P). For example, a trader goes long (in other words, enters a buy position) by entering the market at 1.2980, expecting prices to rally higher. He wants to benefit from the rise, so he places a Take Profit order at a level higher than the entry price, say 1.3180.