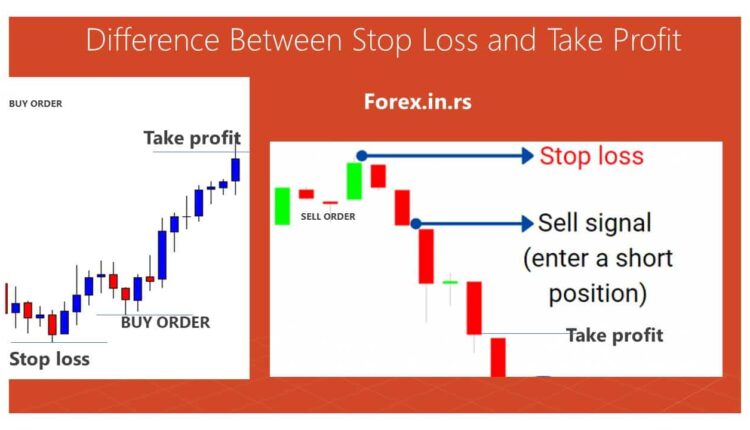

A stop loss order is when a trader indicates when they are ready to close their position, even if they are not near their device. Forex Stop Loss and Take Profit orders are executed automatically by trading platforms.

Is it better to take profit or stop loss?

A stop loss order helps you to define your risk ratio and the amount you are prepared to lose as part of a single trade. Meanwhile, a take-profit order can be used to circumvent the innately human traits of greed by locking in profits on short or long-term price moves.

How do you know where to put stop loss and take profit?

In the support method, an investor determines the most recent support level of the stock and places the stop-loss just below that level. The moving average method sees the stop-loss placed just below a longer-term moving average price.

When should you take stop loss?

For example, if a company’s stock is trading at $30 and you believe it will go up, you can place a stop-loss order at $25. In this case, you will make a profit if the price moves above $30. At the same time, if it drops to $25, the trade will be stopped, limiting the amount of losses that you can make.

When should I take profit in trading?

Take-profit orders are best used by short-term traders interested in managing their risk. This is because they can get out of a trade as soon as their planned profit target is reached and not risk a possible future downturn in the market.

Is it better to take profit or stop loss?

A stop loss order helps you to define your risk ratio and the amount you are prepared to lose as part of a single trade. Meanwhile, a take-profit order can be used to circumvent the innately human traits of greed by locking in profits on short or long-term price moves.

How do you know where to put stop loss and take profit?

In the support method, an investor determines the most recent support level of the stock and places the stop-loss just below that level. The moving average method sees the stop-loss placed just below a longer-term moving average price.

When should I take profit in trading?

Take-profit orders are best used by short-term traders interested in managing their risk. This is because they can get out of a trade as soon as their planned profit target is reached and not risk a possible future downturn in the market.

Why you should not put stop loss?

Disadvantages of Stop-Loss Orders The main disadvantage is that a short-term fluctuation in a stock’s price could activate the stop price. The key is picking a stop-loss percentage that allows a stock to fluctuate day-to-day, while also preventing as much downside risk as possible.

Do we need to put stop loss everyday?

You cannot set a stop loss for more than a day. However, there are many sites which offer a price alert option. For eg, if you want a stop loss at Rs. 100, set a price alert at Rs 105 so that you can be alerted in time.

What is the best stop loss strategy?

The Average True Range (ATR) trailing stop strategy is one of the best trailing stop-loss strategies and is very popular among traders. The strategy’s popularity is based on the fact that it is based on an asset’s current volatility. Hence, it is an accurate reflection of the price action.

Can I set stop loss and take profit at the same time?

You can use the Full-Trade feature to set entry, stop-loss, and take-profit for a trade all at the same time.

What’s a good stop loss percentage?

Stock Trader explained that stop-loss orders should never be set above 5 percent [3]. This is to avoid selling unnecessarily during small fluctuations in the market. Realistically, a stock could fall by 5 percent midday, but rebound. You wouldn’t want to sell prematurely and lose out on potential gains.

Do stop losses ever fail?

No, stop losses do not always work. Although they manage to prevent big losses in normal market conditions, they are by no means bulletproof. Some examples of when setting a stop loss will not help at all, include market lockdowns, extremely low liquidity, and when the market gaps against you.

Should I use stop-loss for long term?

Long term investors use trailing stop losses quite effectively. To conclude, the concept of stop loss is intended to limit your downside risk, protect your capital and instil trading discipline in you.

Do stop losses always work?

In short, a stop-limit order doesn’t guarantee you will sell, but it does guarantee you’ll get the price you want if you can sell.

What is the 8 week hold rule?

What is the best take profit strategy?

At what percentage should you take profits on day trading?

At what percent should you cut losses?

To make money in stocks, you must protect the money you have. Live to invest another day by following this simple rule: Always sell a stock it if falls 7%-8% below what you paid for it.

Is stop loss good for long term?

Using trailing stop losses effectively Long term investors use trailing stop losses quite effectively. To conclude, the concept of stop loss is intended to limit your downside risk, protect your capital and instil trading discipline in you.

Do stop losses ever fail?

No, stop losses do not always work. Although they manage to prevent big losses in normal market conditions, they are by no means bulletproof. Some examples of when setting a stop loss will not help at all, include market lockdowns, extremely low liquidity, and when the market gaps against you.