Most of the time, the key is focusing on the percentage of profits you’ve already made. People have different preferences depending on how much risk they’re willing to take. However, most traders target at least 50% before they take profits. That being said, you can target 100% profits too before you decide to take.

When should I take profits in crypto?

One of the best times for taking profits in crypto is when you spot the formation of a bearish chart pattern. Death crosses, head and shoulders, shooting stars and other bearish patterns often signal trend reversals, and should be incorporated into any crypto profit-taking strategy.

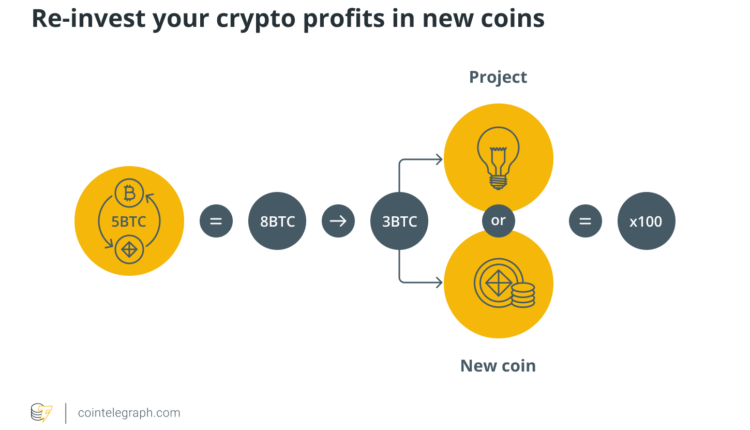

Should I take profits and reinvest in crypto?

Instead of putting your crypto profits into depreciating assets, you should consider reinvesting your crypto profits into safer asset classes like stocks as they can offer you an opportunity to increase your capital without incurring as much risk as you would with crypto.

Should you cash out profits crypto?

To take out and optimize your gains, sell 5-10% at a time, depending on how big your holdings are in that particular crypto. If the coin has gained more than 30% since you bought it, consider selling a small percentage every week.

When should I take profits in crypto?

One of the best times for taking profits in crypto is when you spot the formation of a bearish chart pattern. Death crosses, head and shoulders, shooting stars and other bearish patterns often signal trend reversals, and should be incorporated into any crypto profit-taking strategy.

Should you cash out profits crypto?

To take out and optimize your gains, sell 5-10% at a time, depending on how big your holdings are in that particular crypto. If the coin has gained more than 30% since you bought it, consider selling a small percentage every week.

How long should I hold crypto?

Rather than attempting to trade in the short-term, this strategy promotes holding an asset long-term and riding out the highs and lows. Anjali Jariwala, certified financial planner, certified public accountant and founder of Fit Advisors, recommends holding bitcoin for at least 10 years.

Should I sell my crypto when its high?

If your investment has shot up in value, you should probably sell at least a portion of it. For example, you could sell what you originally invested, and then you’re playing with house money going forward. Because of how volatile crypto is, profits can disappear quickly.

Can you make 100 a day trading crypto?

Here’s all you need to learn regarding generating income from day trading if you’re only commencing out with cryptocurrency. By investing roughly $1000 while monitoring a 10% increase solely on a single combination, it is possible to earn $100 every day in bitcoin.

How much should I put into crypto as a beginner?

How much money do I need to start investing in cryptocurrency? In theory it takes only a few dollars to invest in cryptocurrency. Most crypto exchanges, for example, have a minimum trade that might be $5 or $10. Other crypto trading apps might have a minimum that’s even lower.

Do crypto profits count as income?

The IRS classifies cryptocurrency as a type of property, rather than a currency. If you receive Bitcoin as payment, you have to pay income taxes on its current value. If you sell a cryptocurrency for a profit, you’re taxed on the difference between your purchase price and the proceeds of the sale.

How can you avoid paying tax on crypto profit?

As long as you are holding cryptocurrency as an investment and it isn’t earning any income, you generally don’t owe taxes on cryptocurrency until you sell. You can avoid taxes altogether by not selling any in a given tax year.

How do crypto millionaires cash out?

Use an exchange to sell crypto One of the easiest ways to cash out your cryptocurrency or Bitcoin is to use a centralized exchange such as Coinbase. Coinbase has an easy-to-use “buy/sell” button and you can choose which cryptocurrency you want to sell and the amount.

What is a good investment strategy for crypto?

Buy & Hold – Long term This type of investing is low-stress and suits people who believe in the long term potential of crypto and are willing to hold out for a long time, regardless of short term fluctuations in the markets. Holding or ‘HODLing’ is a great strategy for beginners and veteran traders alike.

What is a good exit strategy for crypto?

One of the simplest exit strategies is selling your cryptocurrencies based on price or percentage targets. For example, if you bought a cryptocurrency at $10, you might set your target sale price at $15.

Which crypto trading strategy is good for beginners?

DCA (Dollar Cost Averaging) If you’re looking for a crypto trading strategy that doesn’t involve indicators, then dollar cost averaging (DCA) might interest you. DCA is a popular strategy for both beginner traders and experts alike.

When should I take profits in crypto?

One of the best times for taking profits in crypto is when you spot the formation of a bearish chart pattern. Death crosses, head and shoulders, shooting stars and other bearish patterns often signal trend reversals, and should be incorporated into any crypto profit-taking strategy.

Should you cash out profits crypto?

To take out and optimize your gains, sell 5-10% at a time, depending on how big your holdings are in that particular crypto. If the coin has gained more than 30% since you bought it, consider selling a small percentage every week.

Is 10% crypto too much?

Most experts agree that cryptocurrencies should make up no more than 5% of your portfolio.

Is it worth putting 100 in crypto?

Is holding crypto better than trading?

Hodling can be a safer option for investors, as they are less exposed to short-term volatility and remove the risk of buying high and selling low, which can frequently happen in crypto. True hodlers tend to hold onto their coin or token, even if the market crashes or becomes highly volatile.