Can cryptocurrency be audited?

Some of the large audit firms are developing crypto auditing software and analytical tools. Auditor training programmes for crypto are also becoming more prevalent. Auditors are also turning to crypto valuers to assist with assurance projects where clients are particularly exposed to crypto.

Does the IRS know you have crypto?

Yes, the IRS can track crypto as the agency has ordered crypto exchanges and trading platforms to report tax forms such as 1099-B and 1099-K to them. Also, in recent years, several exchanges have received several subpoenas directing them to reveal some of the user accounts.

Will the IRS know if I don’t report cryptocurrency?

The simplest answer to this question is — yes! All of your bitcoin profits, gains, and exchanges must be reported to the IRS. If the IRS has reason to believe you have engaged in tax fraud, they may audit you. Years from now, investors may be hit with an inquiry and a tax bill they are unable to pay.

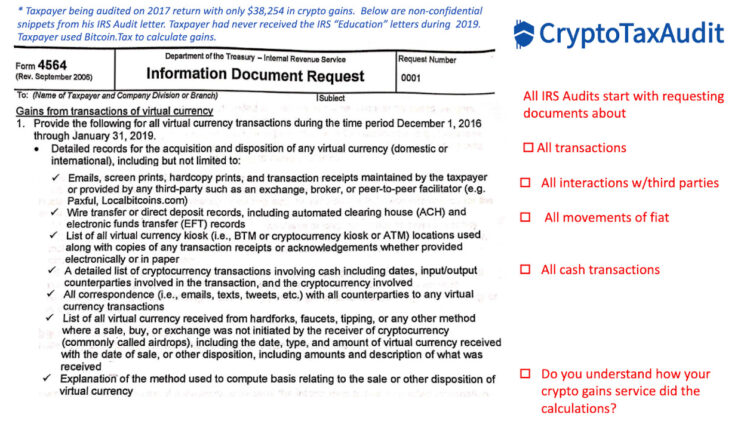

What happens in a crypto audit?

In the case of a cryptocurrency audit, you will also need a detailed report of your trading history for the years in question. The audit examiner’s primary goal is to determine whether you reported correctly and paid the right amount in taxes. At the end of your audit, they will assess the amount owed.

What happens if you lie about crypto on taxes?

If you don’t report taxable crypto activity and face an IRS audit, you may incur interest, penalties, or even criminal charges. It may be considered tax evasion or fraud, said David Canedo, a Milwaukee-based CPA and tax specialist product manager at Accointing, a crypto tracking and tax reporting tool.

Will the IRS audit my crypto?

Buying and selling crypto doesn’t trigger an audit, but the IRS does ask you to report multiple types of crypto transactions and accurately report your gains or losses.

What triggers IRS audit crypto?

Crypto exchanges typically send 1099-B or 1099-K forms to clients that exceed certain transaction thresholds. Since the IRS receives copies of these, a failure to report income triggers the IRS’ Automated Under reporter Program.

Does IRS look at Coinbase?

Yes. Coinbase reports your cryptocurrency transactions to the IRS before the start of tax filing season. As a Coinbase.com customer, you’ll receive a 1099 form if you pay US taxes and earn crypto gains over $600. Yes.

What happens if I forgot to file crypto?

Will I get audited if I don’t report crypto?

How long does a crypto audit take?

How long does a crypto tax audit typically take? The maximum length of an audit is 3 years. However, the length of a crypto tax audit can vary heavily depending on the specifics of your situation.

What happens if you don’t report crypto losses?

After an initial failure to file, the IRS will notify any taxpayer who hasn’t completed their annual return or reports. If, after 90 days, you still haven’t included your crypto gains on Form 8938, you could face a fine of up to $50,000.

What does IRS look for in crypto?

Generally, the IRS treats cryptocurrency as “property”, similar to stocks, gold, or other investments. This means that a virtual currency will assess capital gains when it’s sold at a profit. For instance, if you bought your Bitcoin and then exchanged or sold it, you have to pay taxes for that gain.

How does IRS audit crypto transactions?

Crypto exchanges typically send 1099-B or 1099-K forms to clients that exceed certain transaction thresholds. Since the IRS receives copies of these, a failure to report income triggers the IRS’ Automated Under reporter Program.

How much does it cost to audit a cryptocurrency?

The exact cost of an audit depends on the number of smart contracts to be checked. Typically, an audit will run into thousands of dollars. A particular large project can easily cost over $10,000. The audit company running your audit and its reputation will also affect how much you pay.

Who gets audited by IRS the most?

IRS audits individuals to verify if they accurately reported their taxes and, if they didn’t, to determine if more taxes are owed. Audit trends vary by taxpayer income. In recent years, IRS audited taxpayers with incomes below $25,000 and those with incomes of $500,000 or more at higher-than-average rates.

How likely is it to get audited by the IRS?

What is the chance of being audited by the IRS? The overall audit rate is extremely low, less than 1% of all tax returns get examined within a year.

Which crypto does not report to IRS?

How many people file crypto taxes?

How does the government track crypto?

A fundamental characteristic of blockchain technology is transparency, meaning that anyone, including the government, can observe all cryptocurrency transactions conducted via that blockchain. Bitcoin transactions are publicly accessible because of the transparent nature of blockchain technology.

Do I need to report crypto if I didn’t sell?

Buying crypto on its own isn’t a taxable event. You can buy and hold cryptocurrency without any taxes, even if the value increases. There needs to be a taxable event first, such as selling the cryptocurrency. The IRS has been taking steps to ensure that crypto investors pay their taxes.