One of the best times for taking profits in crypto is when you spot the formation of a bearish chart pattern. Death crosses, head and shoulders, shooting stars and other bearish patterns often signal trend reversals, and should be incorporated into any crypto profit-taking strategy.

How much profits should you take in crypto?

Most of the time, the key is focusing on the percentage of profits you’ve already made. People have different preferences depending on how much risk they’re willing to take. However, most traders target at least 50% before they take profits. That being said, you can target 100% profits too before you decide to take.

At what percentage do you take profits from crypto?

To take out and optimize your gains, sell 5-10% at a time, depending on how big your holdings are in that particular crypto. If the coin has gained more than 30% since you bought it, consider selling a small percentage every week.

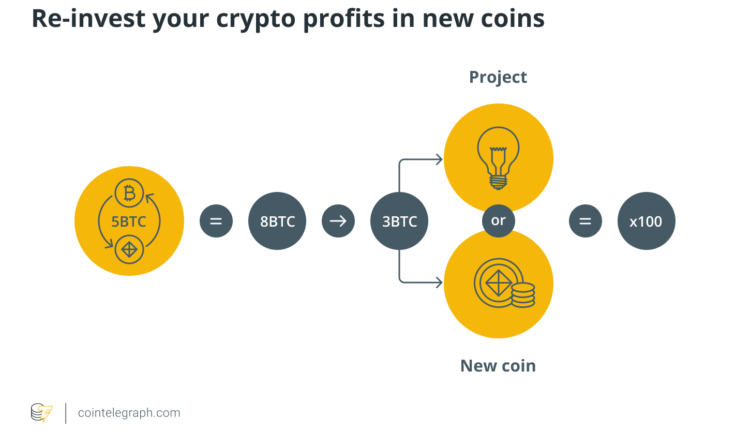

Should I reinvest my profit on crypto?

Instead of putting your crypto profits into depreciating assets, you should consider reinvesting your crypto profits into safer asset classes like stocks as they can offer you an opportunity to increase your capital without incurring as much risk as you would with crypto.

How do you take-profit while trading crypto?

A take-profit order is set up to maximize short-term profits on crypto investment. It does this by setting up a trigger price. For a take-profit order, the trigger price will always be higher than what the trader first paid. This means a trader will always sell at a profit, no matter the initial price.

How much profits should you take in crypto?

Most of the time, the key is focusing on the percentage of profits you’ve already made. People have different preferences depending on how much risk they’re willing to take. However, most traders target at least 50% before they take profits. That being said, you can target 100% profits too before you decide to take.

At what percentage do you take profits from crypto?

To take out and optimize your gains, sell 5-10% at a time, depending on how big your holdings are in that particular crypto. If the coin has gained more than 30% since you bought it, consider selling a small percentage every week.

How do you take-profit while trading crypto?

A take-profit order is set up to maximize short-term profits on crypto investment. It does this by setting up a trigger price. For a take-profit order, the trigger price will always be higher than what the trader first paid. This means a trader will always sell at a profit, no matter the initial price.

How long should I hold crypto?

Rather than attempting to trade in the short-term, this strategy promotes holding an asset long-term and riding out the highs and lows. Anjali Jariwala, certified financial planner, certified public accountant and founder of Fit Advisors, recommends holding bitcoin for at least 10 years.

Should I sell my crypto when its high?

If your investment has shot up in value, you should probably sell at least a portion of it. For example, you could sell what you originally invested, and then you’re playing with house money going forward. Because of how volatile crypto is, profits can disappear quickly.

Can you make 100 a day trading crypto?

Here’s all you need to learn regarding generating income from day trading if you’re only commencing out with cryptocurrency. By investing roughly $1000 while monitoring a 10% increase solely on a single combination, it is possible to earn $100 every day in bitcoin.

Is it better to hold crypto or buy and sell?

Hodling can be a safer option for investors, as they are less exposed to short-term volatility and remove the risk of buying high and selling low, which can frequently happen in crypto. True hodlers tend to hold onto their coin or token, even if the market crashes or becomes highly volatile.

What happens if I dont file my crypto gains?

After an initial failure to file, the IRS will notify any taxpayer who hasn’t completed their annual return or reports. If, after 90 days, you still haven’t included your crypto gains on Form 8938, you could face a fine of up to $50,000.

Can you cash out crypto profits?

Cashing out your Bitcoin (or other cryptos) has gotten easier. You can withdraw it via a crypto exchange, an online broker, a Bitcoin ATM, or a crypto debit card, or even spend it at crypto-friendly businesses.

How much should I put into crypto as a beginner?

How much money do I need to start investing in cryptocurrency? In theory it takes only a few dollars to invest in cryptocurrency. Most crypto exchanges, for example, have a minimum trade that might be $5 or $10. Other crypto trading apps might have a minimum that’s even lower.

What percentage of your portfolio should be in crypto?

The massive volatility of cryptocurrency assets indicates that it’s advisable not to make it a significant portion of your portfolio. That is, aim for 5% or less, not your entire retirement portfolio.

How much does an average person make off crypto?

How much profits should you take in crypto?

Most of the time, the key is focusing on the percentage of profits you’ve already made. People have different preferences depending on how much risk they’re willing to take. However, most traders target at least 50% before they take profits. That being said, you can target 100% profits too before you decide to take.

At what percentage do you take profits from crypto?

To take out and optimize your gains, sell 5-10% at a time, depending on how big your holdings are in that particular crypto. If the coin has gained more than 30% since you bought it, consider selling a small percentage every week.

How do you take-profit while trading crypto?

A take-profit order is set up to maximize short-term profits on crypto investment. It does this by setting up a trigger price. For a take-profit order, the trigger price will always be higher than what the trader first paid. This means a trader will always sell at a profit, no matter the initial price.

Can a crypto go up 1000%?

What is the smartest way to invest in crypto?

The most popular place to purchase cryptocurrency are cryptocurrency exchanges. There are several different exchanges to choose from, with the most popular being Coinbase, GDAx and Bitfinex. These exchanges allow you purchase currencies like Bitcoin and Ethereum with a debit card.