Within the U.S., buying and selling Bitcoin is legal in every state, and Bitcoin mining is almost always legal for individuals. Organizations can also legally buy, sell, trade, hold, and mine Bitcoin, but they may have to comply with additional local, state, or federal regulations.

Can you Bitcoin mine in the US?

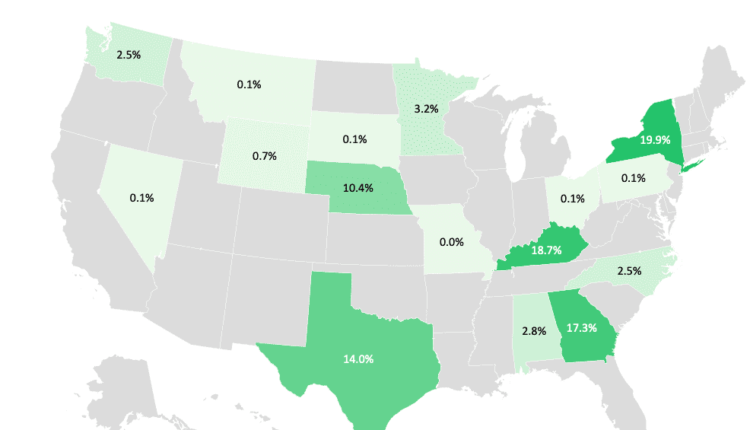

In recent years, operations have moved to the U.S. as previous hubs such as China have banned Bitcoin mining. They’ve become concentrated in Texas, with its deregulated energy grid, as well as in New York. Respectively, the two states account for 14% and 19.9% of Bitcoin’s computing power within the United States.

Are Bitcoin miners illegal?

Bitcoin mining is legal in most countries, but several jurisdictions have banned this practice. China, one of the world’s largest economies, has outlawed bitcoin mining. The nation’s government has also prohibited all cryptocurrency transactions.

Is Bitcoin mining taxable in USA?

Tax on crypto mining USA Regardless of the scale you’re mining at, you’ll pay Income Tax on new coins you receive through mining. You’ll pay Income Tax based on the fair market value of the coin in USD on the day you received it. This will be taxed at the same rate as your Federal and State Income Tax rates.

Do you need a license to mine bitcoin?

Where is crypto mining banned?

How long does it take to mine 1 Bitcoin?

It takes around 10 minutes to mine just one Bitcoin, though this is with ideal hardware and software, which isn’t always affordable and only a few users can boast the luxury of. More commonly and reasonably, most users can mine a Bitcoin in 30 days.

Is it legal to do crypto mining?

Can the IRS track crypto mining?

Despite the anonymous nature of cryptocurrencies, the IRS may still have ways of tracking your crypto activity. For example, if you trade on a crypto exchange that provides reporting through Form 1099-B, Proceeds from Broker and Barter Exchange Transactions, they’ll provide a reporting of these trades to the IRS.

Does the IRS know if you mine crypto?

The answer is yes, according to the IRS guidelines. When one mines cryptocurrencies successfully, they must report the fair market value of the mined tokens as of the date of receipt as their gross income, the IRS said.

Can crypto mining be tracked?

Can the IRS track crypto mining? Yes. All transactions on the blockchain are publicly visible.

How much does it cost to mine Bitcoin in US?

The cost of production for a large mining company is around $8,000 per token, assuming average electricity prices and fairly new mining machines, according to Arcane Crypto.

How long does it take to mine 1 Bitcoin?

It takes around 10 minutes to mine just one Bitcoin, though this is with ideal hardware and software, which isn’t always affordable and only a few users can boast the luxury of. More commonly and reasonably, most users can mine a Bitcoin in 30 days.

What percent of Bitcoin mining is in the US?

Is it still possible to mine Bitcoin at home?

What US mining is illegal?

Illegal mining is mining activity that is undertaken without state permission, in particular in absence of land rights, mining licenses, and exploration or mineral transportation permits.

Can I mine Bitcoin in Florida?

Florida is home to some of the largest Bitcoin mining facilities in the world. These facilities have made use of the state’s resources to power their operations. The progress of Bitcoin mining in Florida has had a positive impact on the state’s economy.

What is needed to mine 1 bitcoin?

With today’s difficulty rate but much more advanced systems, it may take a solo miner about 10 minutes to mine one bitcoin. The average rate for most miners, however, stands at 30 days.

Can an individual do Bitcoin mining?

Other than powerful hardware requirements, miners need specific software such as CG miner, XMR miner, multiminer. Many of this software are free to download and can run on Windows and Mac computers. Once the software is connected to the necessary hardware, you are all set for Bitcoin mining.

How is mining crypto taxed?

Crypto mining as a hobby Bitcoin, Ethereum, or other cryptocurrencies mined as a hobby is reported on your Form 1040 Schedule 1 on Line 8 as “other Income.” It is taxed at your income bracket’s tax rate . This approach to mining taxes is the simplest. However, hobby mining is not eligible for business deductions.

Is crypto illegal anywhere in the US?

Despite its use for buying goods and services, there are still no uniform international laws that regulate Bitcoin. Many developed countries allow Bitcoin to be used, such as the U.S., Canada, and the U.K.

Why is mining crypto illegal?

The legality of Bitcoin mining depends entirely on your geographic location. The concept of Bitcoin can threaten the dominance of fiat currencies and government control over the financial markets. For this reason, Bitcoin is completely illegal in certain places.