Does FTX report to the IRS? Yes. FTX.US issues Form 1099-MISC in the event that a customer earns more than $600 of ordinary income on the platform.

Does FTX pay taxes?

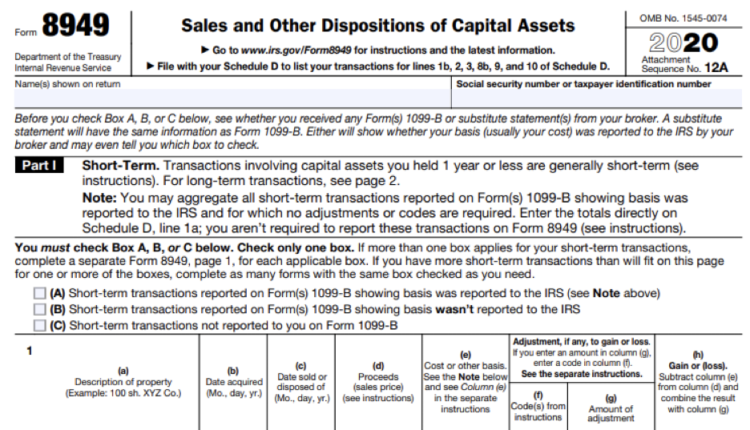

Do you pay taxes for trading NFTs on FTX.US? Yes, trading NFTs in the US is a taxable event, subject to capital gains taxes. In the US, crypto and NFTs are taxed similarly, with the need to determine the gain/loss on each trade and report it on Form 8949.

How do I file taxes with FTX?

FTX Tax Reporting Simply navigate to your FTX account and download your transaction history from the platform. Import your transaction history directly into CoinLedger. Import the file as is. No manual work is required!

Does Coinbase report to IRS?

Yes. Coinbase reports your cryptocurrency transactions to the IRS before the start of tax filing season. As a Coinbase.com customer, you’ll receive a 1099 form if you pay US taxes and earn crypto gains over $600. Yes.

Does Okcoin report to IRS?

Does FTX pay taxes?

Do you pay taxes for trading NFTs on FTX.US? Yes, trading NFTs in the US is a taxable event, subject to capital gains taxes. In the US, crypto and NFTs are taxed similarly, with the need to determine the gain/loss on each trade and report it on Form 8949.

Does FTX us send 1099 to IRS?

The crypto exchange or platform also sends a copy of Form 1099-MISC to the IRS.

Is FTX audited?

vor 6 Tagen

Does FTX US provide tax documents?

As a user of FTX US, a supported TaxBit Network Company, you’re now able to receive FREE Forms 8949 and income reports that are ready to file. Plus, you can connect your FTX US account via the Tax Center to sync all your transactions and discover the impact of potential trades in real time.

Can you use FTX If you live in the US?

U.S. residents can’t trade on FTX’s global platform: Due to strict regulations for the crypto space in the United States, residents of the U.S. have limited access to FTX. The exchange has a U.S. partner, FTX.US, but its offerings are more limited than the global platform.

Can US citizens use FTX?

FTX does not onboard or provide services to personal accounts of current residents of the United States of America, Cuba, Crimea and Sevastopol, Luhansk People’s Republic,Donetsk People’s Republic, Iran, Afghanistan, Syria, North Korea, or Antigua and Barbuda.

Can the IRS see your crypto?

Yes, the IRS can track crypto as the agency has ordered crypto exchanges and trading platforms to report tax forms such as 1099-B and 1099-K to them. Also, in recent years, several exchanges have received several subpoenas directing them to reveal some of the user accounts.

Which crypto platform does not report to IRS?

Will someone know if you report them to the IRS?

We will keep your identity confidential when you file a tax fraud report. You won’t receive a status or progress update due to tax return confidentiality under IRC 6103.

How does the IRS investigate unreported income?

The IRS receives information from third parties, such as employers and financial institutions. Using an automated system, the Automated Underreporter (AUR) function compares the information reported by third parties to the information reported on your return to identify potential discrepancies.

Does FTX US provide tax documents?

As a user of FTX US, a supported TaxBit Network Company, you’re now able to receive FREE Forms 8949 and income reports that are ready to file. Plus, you can connect your FTX US account via the Tax Center to sync all your transactions and discover the impact of potential trades in real time.

Is withdrawal free on FTX?

How does FTX earn make money?

FTX makes money through various trading fees, including maker fees, taker fees, NFT fees, and margin borrower interest. The company also charges interest on its institutional loan service and collects a fee from merchants that want to accept cryptocurrency as a form of payment.vor 6 Tagen

Does FTX pay taxes?

Do you pay taxes for trading NFTs on FTX.US? Yes, trading NFTs in the US is a taxable event, subject to capital gains taxes. In the US, crypto and NFTs are taxed similarly, with the need to determine the gain/loss on each trade and report it on Form 8949.

Can the IRS track a 1099?

IRS reporting Since the 1099 form you receive is also reported to the IRS, the government knows about your income even if you forget to include it on your tax return.

Will crypto exchanges send me a 1099?

Why did I get a 1099-K from Crypto com?

The Form 1099-K states your cumulative amount traded in a tax year: the total value of crypto that you have bought, sold, or traded on an exchange. This form is also known as a Payment Card and Third Party Network Transactions form.