When you place a sell order or cash out USD to a US bank account, the money usually arrives within 1-5 business days (depending on cashout method).

How long does it take to get money from trading account?

In total, the validation process and delivery process generally take about six days to complete. Generally, transfers where the delivering entity is not a broker-dealer (for example a bank, mutual fund, or credit union) will take more time.

How long after trade can I withdraw?

When can I withdraw my funds if I sell my shares or close my positions today? Settlement from any equity based trades i.e sale of stocks from demat, BTST, or intraday is on a T+2 basis. Hence the funds will be available for withdrawal on T+2.

How do I cash out from trading?

Go to the transfers page. Where you find this option depends on the broker you use, but it’s usually on the main navigation bar. Choose the amount and the withdrawal method. You can transfer the money to a bank account, wire it, or request a physical check.

How long does it take to get money after selling shares?

The moment you sell the stock from your DEMAT account, the stock gets blocked. Before the T+2 day, the blocked shares are given to the exchange. On T+2 day you would receive the funds from the sale which will be credited to your trading account after deduction of all applicable charges.

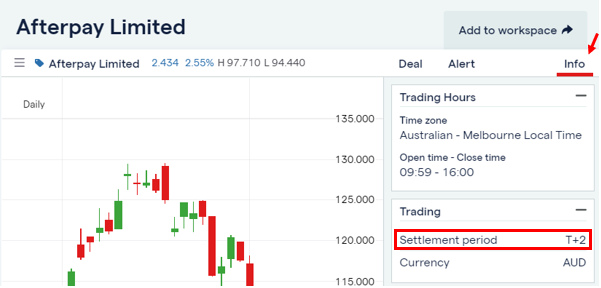

Why does it take 2 days to settle a trade?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an “off-market” basis.

How do I get my money after selling my stock?

Receiving the Money Once the proceeds from the sale of stock have been credited to your brokerage account, you must still get the money from the account. You can set up Automated Clearing House — ACH — transfers, which allow you to get the money to a bank account in one to two additional days.

Do all trades take 2 days to settle?

For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday. For some products, such as mutual funds, settlement occurs on a different timeline.

How long should you hold a trade for?

Ideally, you should hold your trades for as long as your trading plan specifies. If you exit before a pullback, or near the start of a pullback, you’ll typically have smaller winning trades, but you’ll win slightly more often. Practice in a demo account and see which method results in the most consistent performance.

Can I withdraw 1 million from my bank?

A $1 million withdrawal may be a bigger sum than your bank branch has on site. So, you may be required to wait for a week or two before retrieving your newly liquid currency. The money needs to be literally shipped in for special withdrawals, and your bank may require you to provide a few days’ notice.

Do I need 25000 in cash to day trade?

If you want to be a day trader, then the $25,000 minimum balance requirement will apply to your account at all times.

How much profit can you get from trading?

Well, the earnings can go up to Rs. 1 lakh a month or even higher if you are skilled enough and your strategies are in place.

Is trading a good side income?

The answer is both Yes and No. Yes, because there are large funds and institutions that do run short-time frame strategies and make money. Renaissance Technologies is a good example. Then there is the HFT (High frequency trading) space, like Virtu, Citadel and Two Sigma who operate on shorter time frames.

Do shares get sold immediately?

Buying and selling shares on the same day is intraday trading. And when you don’t sell your shares on the same day, your trade becomes a delivery trade. So, in an intraday trade, both the legs of a transaction i.e. buying and selling is executed on the same day.

Can I sell my shares immediately?

No, There is no minimum holding period for selling a stock, infact you can sell a stock almost immediately after you buy it. Buying a stock and selling it within the same day is called as Day trading or Intraday.

When you sell a stock is it sold immediately?

In most situations and at most brokers, the trade will settle — meaning the cash from the sale will land in your account — two business days after the date the order executes.

How long does it take to transfer money from E trade to bank account?

Transfer money electronically: Up to 3 business days. By check: Up to 5 business days. By wire transfer: Same business day if received before 6 p.m. ET. Transfer an account: Electronically – 10+ business days. Mail – 3 to 6 weeks.

Does trading give you money?

Many successful traders may only make profits on 50% to 60% of their trades. However, they make more on their winners than they lose on their losers. Make sure the financial risk on each trade is limited to a specific percentage of your account and that entry and exit methods are clearly defined.

What happens if you day trade more than 3 times in 5 days?

If you execute four or more round trips within five business days, you will be flagged as a pattern day trader. Here’s where you might be dinged: If you’re flagged as a pattern day trader and you have less than $25,000 in your account, you could be restricted from opening new positions.

Can I trade with unsettled funds?

Can you buy other securities with unsettled funds? While your funds remain unsettled until the completion of the settlement period, you can use the proceeds from a sale immediately to make another purchase in a cash account, as long as the proceeds do not result from a day trade.

What happens after you sell stock?

When you sell the stock, you’ll either receive a gain or a loss on your investment. The money from the sale of the stock, including your principal investment and any gains if you sold it for more, should be in your account and settled within two business days. You’ll need to report sales of stock on your tax return.

Who pays the money when you sell a stock?

When you sell your stocks the buyer pays the money; when you buy the stocks the money you paid goes to the seller. The transactions are handled by stock brokers.