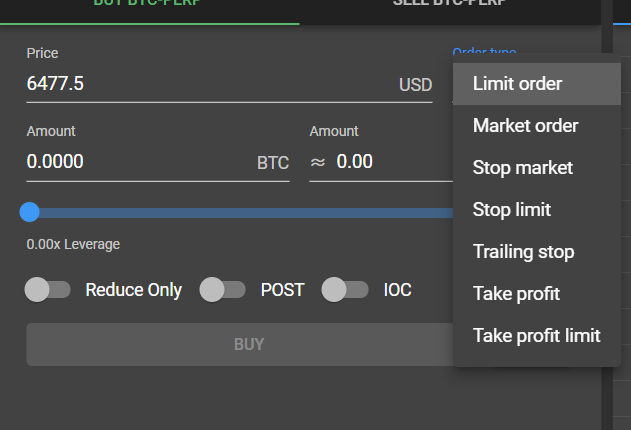

FTX.US offers Stop-Loss Limit, Stop-Loss Market, Trailing Stop, Take Profit, and Take Profit Limit orders. These orders do not enter the order-book until the market price reaches a trigger price, at which point they are sent as orders on the market.

Does FTX have Trailing stop-loss?

FTX.US offers Stop-Loss Limit, Stop-Loss Market, Trailing Stop, Take Profit, and Take Profit Limit orders. These orders do not enter the order-book until the market price reaches a trigger price, at which point they are sent as orders on the market.

Can you do limit orders on FTX us?

FTX US Derivatives exchange is open 24×7. You can place limit orders.

What is reduce only in FTX?

Reduce Only is a special order condition that only allows you to reduce or close a current position you hold. If a Reduce Only order were to increase your position in any way, it will either be immediately canceled or the contract size will be adjusted to prevent an increase.

Does FTX have Trailing stop-loss?

FTX.US offers Stop-Loss Limit, Stop-Loss Market, Trailing Stop, Take Profit, and Take Profit Limit orders. These orders do not enter the order-book until the market price reaches a trigger price, at which point they are sent as orders on the market.

How do you activate stop-loss?

Placing a stop-loss order is ordinarily offered as an option through a trading platform whenever a trade is placed, and it can be modified at any time. A stop-loss order effectively activates a market order once a price threshold is triggered. Traders customarily place stop-loss orders when they initiate trades.

Is trailing stop the same as stop-loss?

Stop-loss orders remain in effect until your position is liquidated or you choose to cancel the order. A trailing stop, also called a trailing stop-loss, is a type of market order that sets a stop-loss at a specific percentage below an asset’s market price, rather than on a single value.

Is trailing stop-loss better than stop-loss?

Why is FTX so popular?

In just three years, FTX has grown to be one of the largest and most popular cryptocurrency exchanges in the market. This is largely due to the exchange’s low trading fees and features that appeal to both new investors and experienced traders.

Why can’t Americans use FTX?

In the case of FTX, U.S. residents cannot trade on its global platform due to strict regulations for the crypto space in the United States. FTX has a U.S. partner, FTX.US, but its offerings are more limited than the global platform.vor 6 Tagen

Are FTX fees high?

Low fees: The fees for trading on FTX.US are among the lowest on exchanges reviewed by NerdWallet. Users of the company’s mobile app, for instance, pay no transaction fees at all (though FTX.US does take a markup in the form of a spread).

Can you short spot on FTX?

Overview. With spot margin trading, users can trade with leverage and go short on spot markets by borrowing from other users (lenders) on FTX, who are looking to earn yield on their assets.

Are FTX fees lower than Coinbase?

Low fees are one of the biggest perks of FTX.US, as it charges less in trading fees than Coinbase and most of the top cryptocurrency exchanges.

How do you add stop-loss on crypto?

Navigate to a trading pair and select Stop-Loss Limit/Take-Profit Limit or Stop-Loss Market/Take-Profit Market under the Stop-Loss Limit dropdown menu. 2. Input the following parameters: Trigger Price – your market order will only be placed on the order book if the market price reaches this trigger price.

How do you set stop-loss in crypto trading?

The stop loss value will adjust according to the crypto asset’s price fluctuations. The trader sets a trailing distance, which is the difference between the current asset price and the stop loss value. If the price of the cryptocurrency rises, the stop loss value will rise with it.

How do you use stop-loss in crypto trading?

To give you a better understanding, try imagining a scenario; You’ve just bought 1 bitcoin for ‘X’ price and set the stop-loss limit to 5%. If Bitcoin’s value goes up, you’ll be profiting, but if it drops down, the stop-loss will sell your investment as a normal market order as soon as the loss percentage hits 5.

Does FTX have Trailing stop-loss?

FTX.US offers Stop-Loss Limit, Stop-Loss Market, Trailing Stop, Take Profit, and Take Profit Limit orders. These orders do not enter the order-book until the market price reaches a trigger price, at which point they are sent as orders on the market.

Are stop losses worth it?

Most investors can benefit from implementing a stop-loss order. A stop-loss is designed to limit an investor’s loss on a security position that makes an unfavorable move. One key advantage of using a stop-loss order is you don’t need to monitor your holdings daily.

Do professionals use stop-loss?

Stop losses are used rampantly among both financial professionals and individuals. They are often considered a means of risk management and some firms even require their traders to use them.

How much does it cost to set a stop-loss?

Stock Trader explained that stop-loss orders should never be set above 5 percent [3]. This is to avoid selling unnecessarily during small fluctuations in the market. Realistically, a stock could fall by 5 percent midday, but rebound. You wouldn’t want to sell prematurely and lose out on potential gains.

What is the best stop-loss and take profit?

Although there is no general way of structuring your stop loss and take profit orders, most traders try to have a 1:2 risk/reward ratio. For instance, if you are willing to risk 1% of your investment, then you can target a 2% profit per trade.

Do professional traders use trailing stop-loss?

Using a trailing stop loss is a great way to lock in profits or limit risk in an active market. In fact, professional futures traders frequently implement these strategies to optimize their capital efficiency in real time.