Are there fees or minimums? The fee is 1.5% of the transaction amount for anything up to $10K. Anything over $10K is a flat fee of $150. The minimum cash out amount must be greater than the fee of $1.00.

How much does Coinbase charge when you sell?

Coinbase charges a flat 1% transaction fee on all cryptocurrency transactions.

How do I withdraw money from Coinbase without fees?

So you can simply type in the amount of Bitcoin you’d like to move from Coinbase to Coinbase Pro, and select “Deposit BTC.” The transfer between the two is instant and free. And then, when you want to withdraw your BTC (maybe to a wallet like Exodus or an exchange like Binance), you will pay no fee whatsoever.

How do I get my cash off of Coinbase?

From a web browser, select your cash balance under Assets. On the Cash out tab, enter the amount you want to cash out and then click Continue. Choose your cash out destination and then click Continue. Click Cash out now to complete your transfer.

Does Coinbase take money when you sell?

There is a 0.1% transaction fee when you sell crypto. All fees we charge you will be disclosed at the time of your transaction. Learn more about Coinbase pricing and fees.

Why did Coinbase charge me 30 dollars?

Coinbase provides a service similar to Paypal. People use it to send and receive money. You are seeing a charge on your statement because someone connected your bank account on our website and used it to purchase bitcoin (a digital currency).

Can I transfer money from my Coinbase wallet to my bank account?

To transfer cash from Coinbase to your linked debit card, bank account, or PayPal account, you first need to sell cryptocurrency to your USD balance. After this, you can cash out the funds.

Can you cash out instantly on Coinbase?

Since your local currency is stored within your Coinbase account, all buys and sells occur instantly. Cashing out to your bank account via SEPA transfer generally takes 1-2 business days. Cashout by wire should complete within one business day.

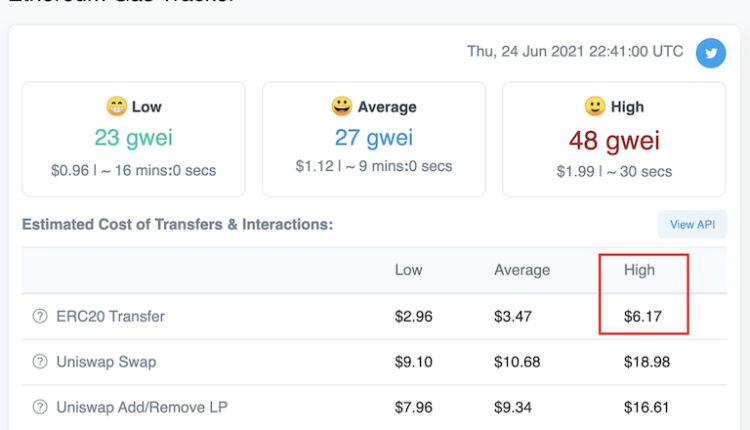

Why is Coinbase wallet fee so high?

Why are Coinbase Wallet Miner Fees so High? The main reason bitcoin mining fees are high is supply and demand. The bitcoin block size is 1MB, meaning that miners can only confirm 1MB of transactions per block (one block every ten minutes).

How long does it take to cash out Coinbase?

For US customers, Coinbase uses the ACH bank transfer system for transfers to your bank account. The ACH bank transfer system typically takes 3-5 business days to complete after initiating a sell or withdrawal. Coinbase will deduct the balance from your source of funds and begin the bank transfer immediately.

Why did Coinbase give me $100?

Coinbase is giving bitcoin credit worth $100 to customers who got an email alerting them to a security change in error. Around 125,000 users were told their two-factor authentication settings had changed, sparking fears they had been hacked.

Are Coinbase fees worth it?

Are Coinbase Fees Worth It? For those who have only a casual interest in cryptocurrency or those who are just learning about it, the price may be worth it in exchange for the convenience of trading in a fiat currency and using a highly intuitive interface. It’s easy to minimize fees using the Coinbase network.

Why does Coinbase not let me cash out?

It’s directly related to purchasing crypto or adding cash in local currency using a linked bank account. For security reasons, you won’t be able to immediately cash out your local currency using a linked bank account or send crypto purchased with such funds off of Coinbase (we call this “cashout availability”).

Why can’t I withdraw money from Coinbase?

You can still buy, sell, and trade within Coinbase. However, you will need to wait until any existing Coinbase Pro account holds or restrictions have expired before you can withdraw funds to your bank account. Withdrawal-based limit holds typically expire at 4 pm PST on the date listed.

How much does it cost to transfer money from Coinbase to bank?

Why do I have to pay a network fee to withdraw? There is a 1% fee to convert and withdraw your crypto to cash in addition to standard network fees. A network fee is necessary in order to have your transaction processed by the decentralized cryptocurrency network.

Does Coinbase report to IRS?

Yes. Coinbase reports your cryptocurrency transactions to the IRS before the start of tax filing season. As a Coinbase.com customer, you’ll receive a 1099 form if you pay US taxes and earn crypto gains over $600. Yes.

Is there a monthly fee for Coinbase?

Primary balance. Coinbase offers our cash and Hosted Cryptocurrency balance service free of charge, allowing you to store your cash and supported cryptocurrency at no cost.

What is Coinbase withdrawal limit?

Withdrawals of both cryptocurrency and fiat currency are limited. Coinbase Pro account holders have a daily withdrawal limit of $50,000/day. This amount applies across all currencies (for example, you can withdraw up to $50,000 worth of ETH per day).

Where does your money go when you sell your crypto?

Depending on the payment option, the seller of the Bitcoin may receive a transfer directly to their bank account or card, a wire transfer, or an agreement to receive funds to some of the popular traditional payments platforms.

Is it safe to sell on Coinbase?

Yes. Coinbase is one of the most trusted cryptocurrency exchanges today. It secures cash on FDIC-secured accounts, lets you securely connect and trade crypto via your bank account, and blocks suspicious accounts to ensure user safety.

Why did Coinbase charge me $1?

Charges for exactly 1.00 are not used for card verification and can be ignored. These are caused by the card processing network and are separate from the Coinbase verification amounts. Check to make sure your Coinbase profile is set to the correct country.

How much does Coinbase charge for 10000?

Coinbase Pro uses tiers, with more or higher dollar transactions coming with lower costs. For example: Transactions less than $10,000 pay a 0.50% taker fee or 0.50% maker fee. Transactions $10,000 to $50,000 pay a 0.35% taker fee or 0.35% maker fee.