An ACH withdrawal is an electronic fund transfer from one financial institution to another that is done through the Automated Clearing House (ACH) network. Think of any money transfer you’ve made through your bank account to a different account or a different bank–those are all considered ACH withdrawals.

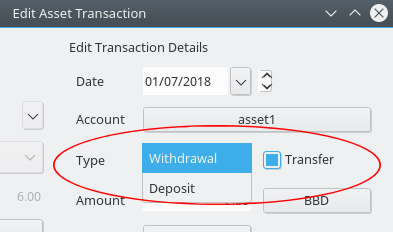

Is withdrawal the same as transfer?

“Transfer” is a shortcut for entering a deposit and a withdrawal with one entry. don’t need to create one withdrawal (from one account (Exchange, Wallet etc.)) plus one deposit (on another account). You can do this in one step.

What is meant by WDL transfer?

A transfer that is done via withdrawal challan and not cheque will be shown as withdrawal transfer.

What is WDL TFR in SBI bank?

If you see TFR on your bank statement, it means you’ve transferred money between bank accounts. An FPI payment is made using the ‘Faster Payment’ electronic system. It means you’ve received money from another account. You’ll find POS on your bank statement if you’ve made a purchase using your debit card.

What is withdrawal account?

Withdrawal accounts are usually set up for partnerships so that each owner can have his spending accounted for. This spending is usually of a personal nature, so the withdrawal account serves the primary purpose of keeping personal spending separate from business spending.

Is withdrawal the same as transfer?

“Transfer” is a shortcut for entering a deposit and a withdrawal with one entry. don’t need to create one withdrawal (from one account (Exchange, Wallet etc.)) plus one deposit (on another account). You can do this in one step.

What is a withdrawal transfer fee?

A withdrawal fee is imposed when funds move out of your bank account. There are several types of withdrawal fees, including transaction, network access and convenience.

Does withdrawing mean money taken out?

What Is a Withdrawal? A withdrawal involves removing funds from a bank account, savings plan, pension, or trust. In some cases, conditions must be met to withdraw funds without penalty, and penalty for early withdrawal usually arises when a clause in an investment contract is broken.

What is ATM WDL fee?

What is transfer option in ATM?

It is an option you get to perform ATM money transfer. Previously, ATMs allowed fund transfers only to added beneficiaries but some banks now allow instant transfers to non-beneficiaries as well. You can opt for ‘Quick Transfer and send money to a payee through NEFT or IMPS.

What is reverse ATM WDL?

This is a scheme where the perpetrator forcibly removes cash from the dispenser prior to the transaction being fully completed and then through the process manipulates the machine to reverse the transaction (i.e. not debit the account). Here is how it works: 1.

What is TRF charge in bank?

TRF is a short form that used to signify the TRANSFER term. It’s a transfer from one bank account to the other account of the same bank account. People use the term TRF in the bank statements, which is generally used to indicate that the money debited or credited to the bank account from another bank account.

What does TFR stand for on a bank statement?

it means you have made an ATM transaction. TFR – Transfer. If you see TFR on your bank statement, it means you have transferred money between bank accounts. FPI – Faster Payment Inwards.

How can I increase my TRF limit?

Click on the Funds Transfer tab, select “Modify TPT Limit” from the Request section, click on “INCREASE”, and chose your desired TPT limit from the drop down menu. Authenticate the transaction with your Debit Card Details + One Time Password (OTP) sent to your registered Mobile number.

What is an example of withdrawal?

The definition of withdrawal is the act of taking something out, or stopping participation in an activity. When you take $10 out of your bank account, this is an example of a withdrawal. When you stop taking cocaine and your body experiences changes as a result of the loss of the drug, this is an example of withdrawal.

What is withdrawal and how does it work?

Withdrawal is the combination of physical and mental effects a person experiences after they stop using or reduce their intake of a substance such as alcohol and prescription or recreational drugs.

How does bank withdrawal work?

Every ATM is slightly different but you simply insert your debit card, enter your PIN (personal identification number), select the account you wish to withdraw money from (if you have more than one), enter the amount and then wait for the ATM to give you your cash and a receipt.

Does an ATM withdrawal count as a transfer?

ATM withdrawals and withdrawals made through a bank teller at a bank branch don’t count toward the six transfers or withdrawal limits each statement cycle.

Is a bank withdrawal a transaction?

Types of Bank Transactions A bank transaction is any money that moves in or out of your bank account. Types of bank transactions include cash withdrawals or deposits, checks, online payments, debit card charges, wire transfers and loan payments.

What does it mean to withdraw from an institution?

You would be withdrawing from the University if you: Transfer to another institution. Leave the University without a definite plan to return.

What does withdraw from something mean?

1 : to take back or away : draw away : remove withdraw money from the bank. 2a : to call back : recall withdrew the charge of theft. b : to take back (one’s words) : retract. 3 : to go away : retreat withdrew to the country.

Is withdrawal the same as transfer?

“Transfer” is a shortcut for entering a deposit and a withdrawal with one entry. don’t need to create one withdrawal (from one account (Exchange, Wallet etc.)) plus one deposit (on another account). You can do this in one step.