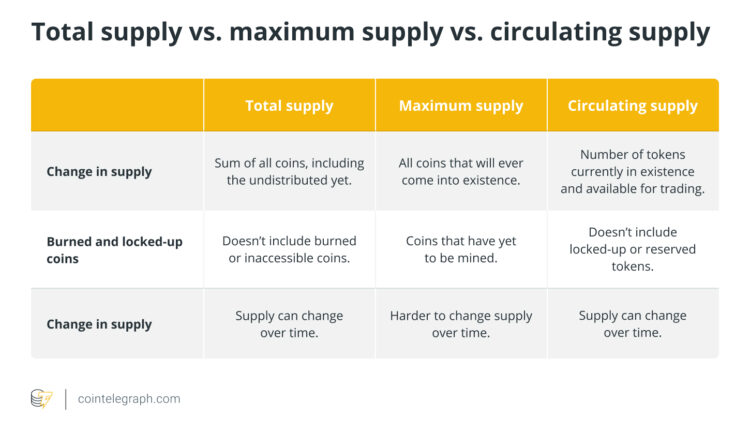

Circulating supply (the number of coins in circulation) and total supply (the maximum number of coins that can exist) are key determinants of a coin’s price.

Does circulating supply affect price crypto?

The circulating supply helps us calculate the market capitalization of every coin. Additionally, regulating scarcity mitigates demand and impacts the coin’s price.

What happens when circulating supply reaches maximum supply?

Generally speaking, when the maximum supply is reached, there will be fewer coins available on the market. This is expected to create market scarcity, which may eventually lead to deflation conditions (or 0% inflation rates).

What happens when circulating supply increases in crypto?

The more coins are in existence, the more demand there needs to be for a price to increase. A low supply means that the token (a share) is scarce and if in high demand, its price will likely rise. On the other hand, if the demand for a cryptocurrency is low but has a large supply, its price may drop.

Does circulating supply affect market cap?

This is the value of all the coins or tokens available for purchase on the market. In other words, a market cap is not calculated by a cryptocurrency’s total supply, but by its circulating supply. Every cryptocurrency has different circulating supplies, and some don’t limit maximum supply.