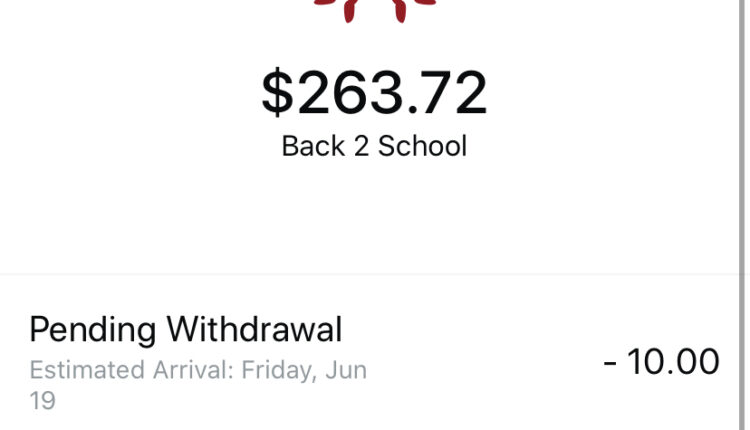

You scheduled a transfer of available cash to your bank account that hasn’t yet cleared. Transfers take four business days to process. Until your transfer clears and the funds appear in your bank account, you’ll see a pending withdrawal status.

Are pending withdrawals already deducted?

How does a Pending Transaction affect my Account balance and credit limit? Pending Transactions are deducted from your available credit immediately, but are not included in your Account balance.

How long does it take for a withdrawal to process?

The timing of a withdrawal depends on several factors including what time of day the withdrawal request is made and the institution receiving your funds, but most withdrawals take 3 or 4 business days before the requested funds are back in your bank account.

How long does an ATM withdrawal Pend?

The bank knows about it, but the funds have not yet been moved. A withdrawal, meanwhile, takes funds from your account immediately. Together, the words pending withdrawal mean funds are leaving your account soon, perhaps in one to three business days.

How long will my withdrawal be pending?

If you see a pending withdrawal in your account, it may be for a couple of reasons: 1. You scheduled a transfer of available cash to your bank account that hasn’t yet cleared. Transfers take four business days to process.

How do I stop pending withdrawals?

A pending transaction will affect the amount of credit or funds you have available. Canceling a pending transaction usually requires contacting the merchant who made the charge. Once a pending transaction has posted, contact your bank or card issuer to dispute it.

What does it mean when a withdrawal is processed?

Processing: Your withdrawal request has been approved and the amount deducted from your balance. Processed: Your withdrawal request has been processed and the balance has been sent to either your crypto withdrawal address or bank account.

How do I know if I’m in withdrawal?

The person may be hot and cold, have goosebumps, or have a runny nose as if they have a cold. Severe withdrawal symptoms, especially for drugs and alcohol, can include paranoia, confusion, tremors and disorientation. Symptoms can last for a few days or weeks, but they will eventually stop.

Are pending bank transactions included in balance?

Your available balance reflects the amount of money in your account before adjusting for pending charges. This is the amount that you can withdraw at any given moment. The current balance (or pending balance) is the amount of money in your account when it accounts for pending transactions.

What is pending withdrawals and debits?

When you use your debit card without entering your PIN, the amount of the transaction is placed on hold in your account until the transaction is processed. During this holding time, usually 2-4 days, the amount will show as a pending debit.

What does pending withdrawals mean on Fanduel?

Meaning that if you submit a check withdrawal request at 11:00 PM, you will have until 5:00 PM the following day to cancel your requested check withdrawal. This requested withdrawal will remain “pending” until it has been successfully processed after 5:00 PM.

Are pending transactions already deducted from account Wells Fargo?

A “pending” transaction is one you have completed and that Wells Fargo is aware of, but has not yet been fully processed for payment from your account. Checks and automatic payments were previously processed from your account only during our nightly processing.

How long can an account be pending?

This varies depending on how long it takes to transfer funds to the merchant. Typically, a transaction will remain pending for two to three days but depending on the merchant and the individual specifications of the transaction, it could remain pending for five to seven plus days.

Can banks remove pending transactions?

A pending transaction can be released or reversed at any time if the Merchant submits a request to the Bank.

Can I tell my bank to stop a pending transaction?

You can tell the card issuer by phone, email or letter. Your card issuer has no right to insist that you ask the company taking the payment first. They have to stop the payments if you ask them to. If you ask to stop a payment, the card issuer should investigate each case on its own merit.

How long does a pending deposit take?

Pending deposits aren’t available for withdrawal; however, they’ll post to your account within one to two business days.

Why is my bank deposit pending?

A pending deposit is money that has been deposited, but not yet authorized for release. Pending deposits show on your account so that you are aware that the actual deposit is processing and forthcoming. Each pending deposit comes with a release date from the company/individual making the deposit into your account.

Do pending deposits Show in available balance?

An account holder’s available balance may be different from the current balance. The current balance generally includes any pending transactions that haven’t been cleared. The available balance is different from the current balance, which includes any pending transactions.

What are the 4 levels of addiction?

There are four levels of addiction: physical, emotional, mental, and spiritual. We will discuss each level in-depth and provide tips for overcoming addiction. Most people who try drugs or engage in risky behaviors don’t become addicted.

How long does an amount stay pending in bank account?

Pending transactions are payments that would normally go into or out of your current account within 7 days. They could be a debit card payment or a cheque you’ve paid in.

What does pending mean on your bank account?

Pending check deposits that have not yet been processed or posted to your account or those that did not receive availability at the time we received the deposit. These funds will be available on the next business day, unless a hold is placed.

What time do pending deposits go through?

In most cases, pending deposits will officially go through between 12 a.m. and 6:30 a.m. EST on the day they are approved. While every bank is different, this is a fairly common timeframe for banks to refresh and update their accounts.