The timing of a withdrawal depends on several factors including what time of day the withdrawal request is made and the institution receiving your funds, but most withdrawals take 3 or 4 business days before the requested funds are back in your bank account.

How long should I wait for my withdrawal to reach my bank account?

During normal working hours, withdrawals are usually processed within a few hours.

How long will my withdrawal be pending?

If you see a pending withdrawal in your account, it may be for a couple of reasons: 1. You scheduled a transfer of available cash to your bank account that hasn’t yet cleared. Transfers take four business days to process.

What does it mean when a withdrawal is processed?

Processing: Your withdrawal request has been approved and the amount deducted from your balance. Processed: Your withdrawal request has been processed and the balance has been sent to either your crypto withdrawal address or bank account.

How long does it take to receive 401k withdrawal?

Depending on who administers your 401(k) account (typically a brokerage, bank or other financial institution), it can take between three and 10 business days to receive a check after cashing out your 401(k).

How long should I wait for my withdrawal to reach my bank account?

During normal working hours, withdrawals are usually processed within a few hours.

Can you withdraw while pending?

Can you withdraw a pending direct deposit? No, a pending direct deposit is not able to be withdrawn as the deposit is still in the process of being verified by your bank. Once the deposit is authorized, you’ll then be able to use these funds, including to withdraw them.

How long does it take to get withdraw?

You could experience withdrawal symptoms within a day or two after you stop drinking. If you chronically, heavily abused alcohol, withdrawal symptoms may begin only a few hours after your last drink. Mild to moderate alcohol withdrawal symptoms typically last a week or two.

Does pending mean the money has already been taken out?

What’s a pending transaction? Pending transactions are transactions that haven’t been fully processed yet. For example, if you make a purchase with a debit card or credit card, it will almost always show as pending immediately when you view your account online or in a mobile banking app.

How long does electronic withdrawal take?

How long does an ACH withdrawal take? ACH withdrawals typically take one to three business days to process, but some financial institutions offer same-day ACH transfers for an additional fee.

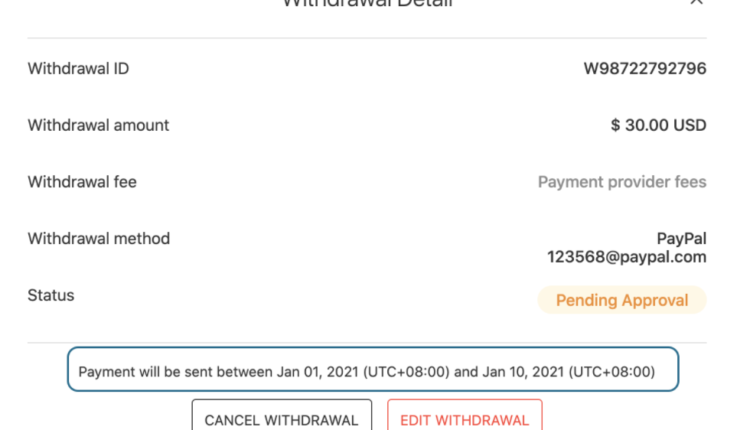

Why is my withdrawal on pending?

What is a pending transaction, and how long can it stay pending? A pending transaction is a recent card transaction that has not yet been fully processed by the merchant. If the merchant doesn’t take the funds from your account, in most cases it will drop back into the account after 7 days.

Does withdraw Mean failed?

Withdrawal usually means the course remains on the transcript with a “W” as a grade. It does not affect the student’s GPA (grade point average).

How long does a pending deposit take?

Pending deposits aren’t available for withdrawal; however, they’ll post to your account within one to two business days.

Does my employer have to approve my 401k withdrawal?

Employers can refuse access to your 401(k) until you repay your 401(k) loan. Additionally, if there are any other lingering financial discrepancies between you and your former employer, they may put on your 401(k) hold.

What is the process to withdraw 401k?

By age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401(k) without having to pay a penalty tax. You’ll simply need to contact your plan administrator or log into your account online and request a withdrawal.

What happens after you withdraw from 401k?

If you withdraw funds early from a 401(k), you will be charged a 10% penalty. You will also need to pay an income tax rate on the amount you withdraw, since pre-tax dollars were used to fund the account. In short, if you withdraw retirement funds early, the money will be treated as income.

How long does it take for money to reach bank account?

Your specific bank transfer time will vary depending on a range of factors, including fraud prevention, different currencies, different time zones, and bank holidays/weekends. In general, the bank transfer time will be around one to five working days.

How long does it take for money to hit your bank account?

Learn more here. You can typically expect credit card payments to show up in your account within 2-3 business days. ACH transfers take approximately 7-10 business days. There is a 5 day bank verification hold on all ACH payments, plus 1-2 days for processing.

Why does my bank take so long to take money out?

The duration of a bank transfer to be successfully made often depends on a number of factors, due to which your transaction can be delayed. This includes the timing of the transfer, where the transfer is being made, the currencies involved, security checks, bank holidays, and the reasons for the transaction.

How long does it take money to go into bank account?

On average, direct deposit usually takes one to three business days to clear. The process is fast, but the actual time frame for the funds to hit your account depends on when the issuer initiates the payment.

How long should I wait for my withdrawal to reach my bank account?

During normal working hours, withdrawals are usually processed within a few hours.

How long can a bank hold funds?

Most of the time, when you deposit a check, a portion of the funds is made available to your account on the same day, with the remainder becoming available on the next business day. 1 Sometimes there are circumstances that cause a check deposit to be placed on a temporary hold of up to seven business days.