No, Bitcoin is perfectly legal to use, exchange and sell in Canada. Just be sure to track the activity in your account and pay the appropriate taxes on any gains or losses.

Is mining cryptocurrency illegal?

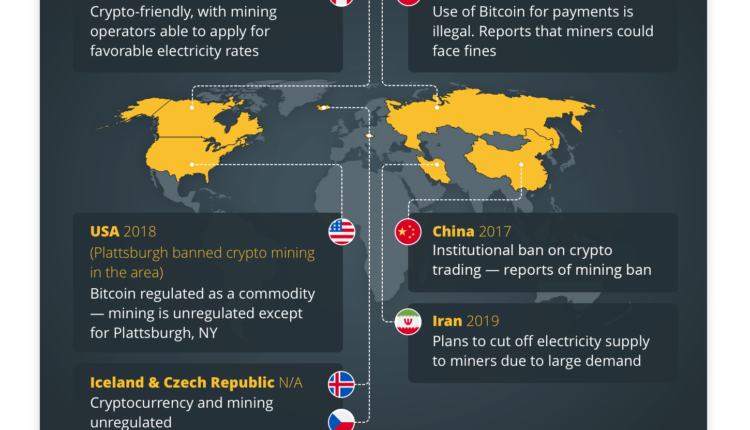

Bitcoin mining is legal in most countries, but several jurisdictions have banned this practice. China, one of the world’s largest economies, has outlawed bitcoin mining. The nation’s government has also prohibited all cryptocurrency transactions.

Is mining legal in Canada?

In Canada, any significant exploration by a prospector will require that prospector to hold the mineral rights to the area of interest. Mineral rights are obtained by “staking” a mineral claim, or a “licence” or “permit” in some jurisdictions.

Is it legal to create a cryptocurrency in Canada?

While cryptocurrency is legal to use in Canada, it is not legal tender. That’s because the government only recognizes the Canadian dollar as the official currency of Canada; legal tender is defined as notes issued by the Canadian Bank and coins from the Royal Canadian Mint Act.

Is crypto mining taxable in Canada?

The CRA does tax most cryptocurrency transactions. Canadians do not have to pay taxes for buying or holding cryptocurrency. Taxpayers are subject to pay capital gains or business income tax after selling or mining cryptocurrency.

Is it legal to create a cryptocurrency in Canada?

While cryptocurrency is legal to use in Canada, it is not legal tender. That’s because the government only recognizes the Canadian dollar as the official currency of Canada; legal tender is defined as notes issued by the Canadian Bank and coins from the Royal Canadian Mint Act.

Where is crypto mining banned?

What countries have banned crypto mining?

Egypt, Iraq, Qatar, Oman, Morocco, Algeria, Tunisia, Bangladesh, and China have all banned cryptocurrency.

Do I pay taxes on mined crypto?

If you earn cryptocurrency by mining it, it’s considered taxable income and might be reported on Form 1099-NEC at the fair market value of the cryptocurrency on the day you received it.

Why is mining a problem in Canada?

Is it legal to create a cryptocurrency in Canada?

While cryptocurrency is legal to use in Canada, it is not legal tender. That’s because the government only recognizes the Canadian dollar as the official currency of Canada; legal tender is defined as notes issued by the Canadian Bank and coins from the Royal Canadian Mint Act.

What Canadian banks allow crypto?

National Bank of Canada and Coast Capital are two financial institutions that allow customers to invest in cryptocurrencies using their credit cards. Users can also buy crypto using their debit card, via wire transfer, or Transfer.

How much taxes do you pay on crypto in Canada?

Is ethereum illegal in Canada?

Even though Ethereum/Ether is not legal tender in Canada, it is not illegal to trade, buy, or sell Ethereum/Ether in Canada, even when using a cryptocurrency exchange or broker. It is important to remember, though, that you could be subject to extra taxes, if you realize capital gains when trade Ethereum for a profit.

How does crypto gains Canada avoid paying taxes?

Unfortunately, there’s no legal way to avoid paying taxes on cryptocurrency in Canada. All transactions above $10,000 must be reported to the CRA by the exchanges directly, and individuals are legally obligated to report gains on transactions below $10,000 in their annual tax filing.

How long does it take to mine 1 Bitcoin?

It takes around 10 minutes to mine just one Bitcoin, though this is with ideal hardware and software, which isn’t always affordable and only a few users can boast the luxury of. More commonly and reasonably, most users can mine a Bitcoin in 30 days.

Can anyone do crypto mining?

Anyone can participate in the Bitcoin mining process, but unless you have access to powerful computers known as ASICs (that’s “application-specific integrated circuits”), your chances of winning a Bitcoin reward are pretty low.

Which crypto Cannot be mined?

Some non-minable coins are for example XRP, EOS, Stellar and NEM. These are cryptocurrency Projects where a developer has completely premined the coins at the start of the project and then later distributed them to the public. So in this scenario all the coins are premined upfront and are usually sold in ICO.

Which country is best for crypto mining?

In fact, some of the countries with the best worldwide internet speed, the Netherlands (107.3 Mbps), Luxembourg (107.94 Mbps) and Iceland (191.83 Mbps) have high monthly internet costs. When it comes to price, Syria emerges as the best country for crypto mining.

Can crypto mining be tracked?

Can the IRS track crypto mining? Yes. All transactions on the blockchain are publicly visible.

Is it better to mine crypto as a hobby or business?

In short: If you’re trying out small-scale crypto mining on your personal computer, you should treat it as a hobby for tax purposes. On the other hand, if you own your own rack server and rely on the income, you should treat it as a business and write off some of your crypto mining taxes.

How do I become a miner in Canada?

Ontario college mining programs typically require an Ontario Secondary School Diploma (OSSD) or equivalent. Academic requirements will vary depending on the program, but generally include senior math and chemistry or physics courses. A grade 12 English credit is often required for technician and technology programs.