Are NFTs gaining popularity?

In the past year or so, NFTs have exploded in popularity. Today, over 1 billion NFTs are on the market, with an average of around 8 million new ones being created monthly. This number is expected to rise even further as more people realize how valuable they can be to transfer value.

When did NFTs peak?

Who popularized NFTs?

How did NFTs become a thing?

How fast are NFTs growing?

For the next five years, trends tied to the global NFT boom continue to factor in the growing involvement of mainstream influencers, gaming communities and the rising demand for digital artworks.

Are NFTs declining?

The world of non-fungible-tokens (NFTs) has plunged after the initial hype that followed their rise in popularity.

Is the NFT hype over?

Hype skyrocketed—but it didn’t last. While the average sale price for a Loot NFT soared to over 21 ETH, or about $84,000 at the time, the speculative frenzy soon faded. Prices fell, volume slowed, and the buzz quieted in the weeks that followed its launch.

Are NFT crashing?

Which country buys the most NFT?

Thailand is home to 5.65 million NFT users in the world. Brazil and the United States stand in the second and third spot with 4.99 million and 3.81 million users, respectively.

What is NFT so popular?

NFTs are popular because they provide a way to create unique digital assets that can represent ownership of tangible and digital world assets. For example, you could create an NFT representing ownership of a house, land, or pair of shoes and then store the tokens on the blockchain, like Ethereum or Cardano.

Who are NFTs aimed at?

Considering that ownership of NFTs among 18-34s aware of the tech is at 29%, this shows strong positivity among the age group, which should be considered the prime target market for any NFT releases. This is furthered when assessing interest levels in a future NFT purchase.

How are NFTs being used today?

NFTs are a perfect fit for the gaming industry. With the digital identification model, players can use NFTs to verify their earnings and secure their winnings in video games. Since NFT objects in games can have varying degrees of rarity, NFTs make trading in games simpler, which can also raise the value.

Why is NFTs worth?

An NFT has value because the buyer and their community believe it has value—which is true for all art and collectibles. And as time goes by, an NFT gains more of its own character, based on factors like who’s owned it and how they’ve used it.

Is there a future for NFTs?

Digital transformation and adoption of blockchain technology also mean the employment landscape is changing. More people are already working on NFTs, blockchains, and cryptocurrencies than ever before, but it will become increasingly common.

How are NFTs disrupting the art world?

NFTs are disrupting the art world by changing the way art is traded. Creators of digital artworks can sell directly to collectors through platforms such as OpenSea and Foundation, cutting out dealers and galleries. Little wonder auction houses are keen on being a part of this big revolution.

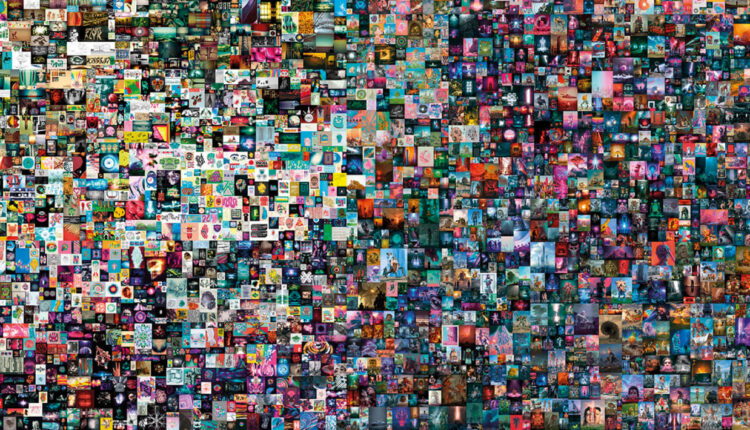

What is the most expensive NFT?

Sale details: The most famous NFT sale (and the most expensive NFT sale to date) was Beeple’s Everydays: The First 5000 Days for $69.3 million.

When did Cryptocurrency become popular?

How often do NFT projects fail?

ABOUT 80% of NFT PROJECTS ARE GOING TO FAIL!

How likely is it to sell an NFT?

It was found that 33.6% of NFT sellers sell their NFTs for $100 or less, and they’re the largest percentile. Those who make the most money, hitting the generally recommended sell-price of 0.5 ETH for NFTs, and above, is a disappointing 1.8%.

How many people own an NFT?

There are around 360,000 people who own NFTs. If you’ve been seeing excessive articles, advertising, and social posts about NFTs, you are not alone.

Is NFT a bubble?

Non-fungible tokens (NFTs) are increasingly popular among both crypto investors and artists. Each NFT asset is completely unique, which is what creates its value. Just as with any market, however, it’s possible for a bubble to form when prices become so inflated that buyers can no longer justify their purchases.