Though there is no ideal time for holding stock, you should stay invested for at least 1-1.5 years. If you see the stock price of your share booming, you will have the question of how long do you have to hold stock?

How long do you hold a stock before selling?

Generally speaking, if you held your shares for one year or less, then profits from the sale will be taxed as short-term capital gains. If you held your shares for more than one year before selling them, the profits will be taxed at the lower long-term capital gains rate.

Should you hold a stock forever?

Holding stocks for the long-term can help you ride the highs and lows of the market, benefit from lower tax rates, and tend to be less costly.

How long do investors hold stocks?

In terms of how long stocks stick around in a portfolio, the average investor holds shares for 5.5 months. This is according to an analysis of New York Stock Exchange (NYSE) data conducted by Reuters.

Should you hold a stock forever?

Holding stocks for the long-term can help you ride the highs and lows of the market, benefit from lower tax rates, and tend to be less costly.

When should you exit a stock?

When you find a stock that has better fundamentals than the one you are holding on to now, it is a good time to exit the stock. This also means that the company is doing better and coming up with better products or services that can grab better opportunities.

When should you pull out of a stock?

When is it smart to pull out of stocks? In some cases it might be smart to pull your money out of certain stocks when they reach a predetermined price (you can use a limit order to set those guardrails); when you want to buy into new opportunities; or add diversification to your portfolio.

At what profit should I sell a stock?

How long does Warren Buffett hold stocks?

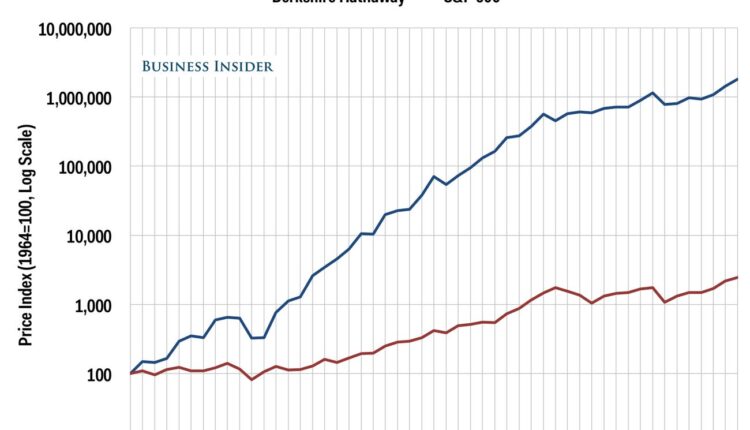

Warren Buffett prefers to hold financial stocks for an extensive period of time. Among the 15 stocks Warren Buffett and his investing team have been holding for between 10 and 34 years, seven are financial stocks: American Express, Moody’s, Globe Life, U.S. Bancorp, Bank of NY Mellon, Mastercard, and Visa.

What is the 8 week hold rule?

Should you hold a stock forever?

Holding stocks for the long-term can help you ride the highs and lows of the market, benefit from lower tax rates, and tend to be less costly.

What is the best exit strategy for stocks?

Stock exit Strategy: Set a Target Price and Stop Loss The golden rule of any trade is to set a target price and a stop loss. The target price is the price at which you’ll exit the position at a profit; the stop loss will cap your losses if the trade doesn’t pan out.

What is the 10 am rule in stocks?

Who buys stock when everyone is selling?

If you are wondering who would want to buy stocks when the market is going down, the answer is: a lot of people. Some shares are picked up through options and some are picked up through money managers that have been waiting for a strike price.

How much do I need in stocks to retire?

Many retirement experts recommend strategies such as saving 10 times your pre-retirement salary and planning on living on 80% of your pre-retirement annual income.

What is the 3 day rule in stocks?

In short, the 3-day rule dictates that following a substantial drop in a stock’s share price — typically high single digits or more in terms of percent change — investors should wait 3 days to buy.

Do I owe money if my stock goes down?

Do I owe money if a stock goes down? If a stock drops in price, you won’t necessarily owe money. The price of the stock has to drop more than the percentage of margin you used to fund the purchase in order for you to owe money.

What is the 70/30 Rule investing?

With a 70/30 investment portfolio, 70 percent of your capital is invested in stocks, and 30 percent is invested in fixed-income products, such as bonds, CDs, and fixed-income exchange-traded and mutual funds.

What is Warren Buffett’s 90 10 rule?

What Is the 90/10 Strategy? Legendary investor Warren Buffett invented the “90/10″ investing strategy for the investment of retirement savings. The method involves deploying 90% of one’s investment capital into stock-based index funds while allocating the remaining 10% of money toward lower-risk investments.

What is the first rule of investing?

Is it time for you to get a new adviser? Warren Buffett once said, “The first rule of an investment is don’t lose [money]. And the second rule of an investment is don’t forget the first rule.

Is it better to buy and sell stocks or hold?

If you are risk-averse and your primary concern is capital preservation and long-term profits, a buy and hold strategy is probably your best choice. If you are okay with more risk and volatility and are willing to put in the time every day to manage your investments, an active trading strategy could work.