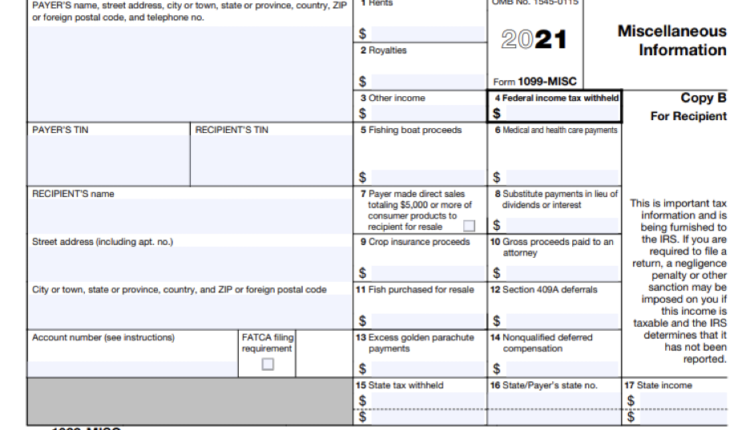

If you’ve earned $600 or more in crypto interest, rewards, staking, or bonuses in a taxable year, you should receive Form 1099-MISC, Miscellaneous Income, from the crypto exchange or platform by January 31st of the following year.

Does FTX us provide 1099?

Yes. FTX.US issues Form 1099-MISC in the event that a customer earns more than $600 of ordinary income on the platform. In the future, FTX.US will be required to report more detailed information to the IRS.

How do I get tax forms from FTX US?

No, FTX does not provide a tax report. However, you can use your FTX transaction history with a crypto tax app to automatically generate an FTX tax report. The simplest way to do this is with the FTX tax report API.

Does FTX send tax forms?

At this time, FTX doesn’t provide tax forms to users. Typically, cryptocurrency exchanges have trouble reporting taxable income to their users. Because investors often transfer their coins across different wallets, it’s difficult to find information on cost basis — which is needed to calculate capital gains and losses.

How do I get a FTX statement?

Go to the Staking page on FTX. In the ‘Staking Reward History’ window, click the ‘Filter time window’ icon (top-right corner) and select a time period that includes all your received staking rewards, and then click ‘Search’. Next, click on the ‘Download CSV’ icon to download the CSV file.

Does FTX us provide 1099?

Yes. FTX.US issues Form 1099-MISC in the event that a customer earns more than $600 of ordinary income on the platform. In the future, FTX.US will be required to report more detailed information to the IRS.

How do I get tax forms from FTX US?

No, FTX does not provide a tax report. However, you can use your FTX transaction history with a crypto tax app to automatically generate an FTX tax report. The simplest way to do this is with the FTX tax report API.

Does FTX US show PnL?

You can find your historical PnL at ftx.com/pnl. Notes: There are many ways to calculate PnL, and different people have different preferences. FTX chose one of these ways to calculate it, but you might prefer a different one.

Why is FTX not allowed in the US?

U.S. residents can’t trade on FTX’s global platform: Due to strict regulations for the crypto space in the United States, residents of the U.S. have limited access to FTX. The exchange has a U.S. partner, FTX.US, but its offerings are more limited than the global platform.

Is FTX US pro the same as FTX US?

Both platforms encourage two-factor authentication (2FA), and both practice cold storage of user funds. The only difference is that FTX has an insurance fund for users that is funded through their trading fees.

Is FTX audited?

vor 6 Tagen

Is FTX legit in USA?

IMPORTANT UPDATE. At this time, we do not recommend opening an account or depositing funds through FTX.US, due to FTX’s recent bankruptcy filing on November 11th. For other options, we suggest reviewing our list of the best crypto apps and exchanges.

Does Coinbase report to IRS?

Yes. Coinbase reports your cryptocurrency transactions to the IRS before the start of tax filing season. As a Coinbase.com customer, you’ll receive a 1099 form if you pay US taxes and earn crypto gains over $600. Yes.

Is withdrawal free on FTX?

Does FTX US have earn?

You can now earn yield on your crypto purchases and deposits, as well as your fiat balances, in your FTX app! By opting in and participating in staking your supported assets in your FTX account, you’ll be eligible to earn up to 8% APY on your assets.

What is FTX withdrawal fee?

You can withdraw below $5000 USD once per rolling week period. Additional withdrawals below $5000 will incur a $25 withdrawal fee. Withdrawals above $5000 USD are free.

How do I download trade history from FTX?

Log on to FTX and choose “Trade History” from the menu. 2. At “Trade History” section, click the calendar icon, choose the full period of your trade, hit “search”, and download the CSV file by hitting the cloud icon.

Is FTX US pro the same as FTX US?

Both platforms encourage two-factor authentication (2FA), and both practice cold storage of user funds. The only difference is that FTX has an insurance fund for users that is funded through their trading fees.

Is FTX audited?

vor 6 Tagen

Is FTX US only for US residents?

FTX does not onboard or provide services to personal accounts of current residents of the United States of America, Cuba, Crimea and Sevastopol, Luhansk People’s Republic,Donetsk People’s Republic, Iran, Afghanistan, Syria, North Korea, or Antigua and Barbuda.

Is FTX US part of FTX?

FTX is incorporated in Antigua and Barbuda and headquartered in The Bahamas. FTX is closely associated with FTX.US, a separate exchange available to US residents.

Does FTX us provide 1099?

Yes. FTX.US issues Form 1099-MISC in the event that a customer earns more than $600 of ordinary income on the platform. In the future, FTX.US will be required to report more detailed information to the IRS.