A negative balance occurs when you buy cryptocurrency or deposit money into your Coinbase account, but Coinbase has not received successful payment from either your bank or card issuer.

Can you go negative with crypto?

A negative balance occurs when you buy cryptocurrency or deposit money into your Coinbase account, but Coinbase has not received successful payment from either your bank or card issuer.

Can you owe money crypto?

Can You Lose More Than You Put In? We’ve established that the value of crypto can never fall below zero. But investors can lose money on crypto investments and see a negative balance depending on their investing strategy.

Can you lose more than you invest in crypto?

Any successful and reasonable investor will tell you to only invest in as much as you can afford to lose. This applies to all markets, and even more so to crypto, which can see double-digit drops in hours.

Do you have to pay back crypto?

A crypto loan is a type of secured loan in which your crypto holdings are used as collateral in exchange for liquidity from a lender that you’ll pay back in installments. As long as you make your payments and pay the loan amount in full, you get your crypto back at the end of the loan term.

Can you lose all your money in crypto?

Can you lose all your money in bitcoin? Yes you certainly can. Crypto is very risky and not like conventional investing in the stock market. Bitcoin’s value is based purely on speculation.

What happens if I dont pay Coinbase?

If you can’t pay Coinbase, your account will be suspended and you will no longer be able to buy or sell cryptocurrencies.

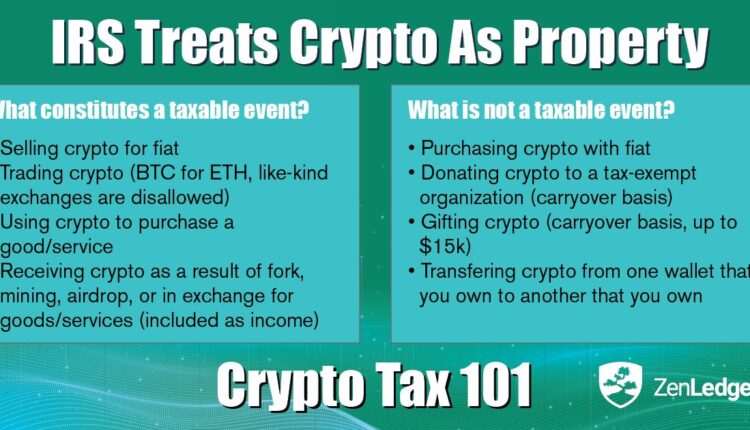

What happens if I don’t pay my crypto taxes?

If you don’t report taxable crypto activity and face an IRS audit, you may incur interest, penalties, or even criminal charges. It may be considered tax evasion or fraud, said David Canedo, a Milwaukee-based CPA and tax specialist product manager at Accointing, a crypto tracking and tax reporting tool.

Can debt collectors go after crypto?

This may come as a surprise to many who wrongly believe cryptocurrency is beyond the reach of the governments and courts, but bitcoin and other cryptocurrencies can be garnished by judgment creditors. Digital assets held in both hot wallets and cold wallets are subject to court orders.

What happens if you don’t pay back a crypto loan?

If you fail to repay the loan, the lender will liquidate or cash out the cryptocurrency. Crypto lenders like BlockFi, Celsius and Unchained Capital have relatively low annual percentage rates and one- to three-year loan terms, but high minimum loan amounts.

How long should you hold your crypto?

Cryptocurrency investing can be a wild ride. To give yourself the best chance of success, it’s important to think not just about buying but also when to sell crypto. When investing in stocks, a good rule is to buy and hold for at least five years.

Can holding crypto make you rich?

There’s no denying that some cryptocurrency traders have become millionaires thanks to their successful investments. What’s not as often discussed is the great number of people who have lost significant sums trying to become rich by investing in crypto.

Can you cash out millions in crypto?

To cash out your funds, you first need to sell your cryptocurrency for cash, then you can either transfer the funds to your bank or buy more crypto. There’s no limit on the amount of crypto you can sell for cash.

Do I pay taxes on crypto if I don’t sell?

Buying crypto on its own isn’t a taxable event. You can buy and hold cryptocurrency without any taxes, even if the value increases. There needs to be a taxable event first, such as selling the cryptocurrency. The IRS has been taking steps to ensure that crypto investors pay their taxes.

Do people actually pay with crypto?

While the number of institutions accepting bitcoin is growing by the day, large transactions involving it are rare. For example, very few real estate deals using cryptocurrency have been reported. Even so, it is possible to buy a wide variety of products from e-commerce websites using bitcoin.

How much tax do I pay on crypto?

Do I have to pay taxes if I lose money on crypto?

You report your crypto losses with the Form 8949 and 1040 Schedule D. Each sale of crypto during the tax year is reported on the 8949. If you had non-crypto investments, they need to be reported on separate Form 8949s when you file your taxes. The example below shows a completed crypto Form 8949, including a loss.

Is crypto taxable if you don’t cash out?

The IRS classifies cryptocurrency as a type of property, rather than a currency. If you receive Bitcoin as payment, you have to pay income taxes on its current value. If you sell a cryptocurrency for a profit, you’re taxed on the difference between your purchase price and the proceeds of the sale.

What if I lose money on crypto?

Trading generates gains or losses every time you buy, sell, or even exchange virtual currencies because the IRS treats crypto as property. If you lost money in cryptocurrency this year, there’s a bit of good news. You can claim that loss on your taxes.

What happens if my investment goes negative?

If there are no funds to pay off creditors, the stockholders receive zero compensation for their shares. In other words, their stock becomes worthless, and they lose their entire investment.

How many people got rich from Bitcoin?

These 19 billionaires have made their riches in the world of cryptocurrency. t’s been a wild twelve months for the world of cryptocurrencies, from the Elon Musk-fueled ascent of Dogecoin, to Web3 innovations and non-fungible tokens (NFTs), to the wild swings in Bitcoin and other crypto tokens.

What happens if you don’t pay Coinbase negative balance?

Since negative balance occurs unexpectedly, you won’t be able to purchase cryptocurrency, transfer crypto, or make cryptocurrency transactions until you complete a transfer or deposit to your account, even if you have paid all the fees related to the transaction.