As a rule of thumb, the fewer coins are available to the general audience, the higher the value of the cryptocurrency becomes. This is especially true when the coin’s maximum supply has been reached: No more mining is possible and the market price reflects supply and demand.Circulating Supply: This is the term used to describe the number of coins that are circulated throughout the world at a given time. Investing in cryptocurrencies with a set or restricted supply may be a good strategy to make money from its future worth. Dealing with a coin with a limited supply nearly always results in a price increase.

Does circulating supply matter in crypto?

Yield. The Circulating Supply metric is of utmost importance within the crypto asset industry and for good reason. It, along with a crypto asset’s per unit price, allows investors to better understand the relative valuation of different assets.

Does circulating supply increase crypto?

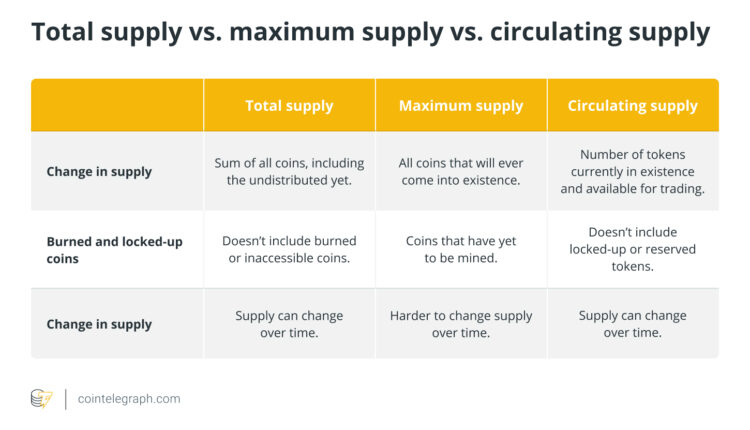

The term circulating supply refers to the number of cryptocurrency coins or tokens that are publicly available and circulating in the market. The circulating supply of a cryptocurrency can increase or decrease over time.

Is low supply good for crypto?

Having a low supply can generate high prices but only when demand is increasing as well. A low coin supply cryptocurrency with no demand is just a coin with a low supply.

Is less circulating supply better?

The circulating supply is always a percentage of the total supply – the higher the percentage, the better. For example, Bitcoin has a circulating supply of 19 million, which is about 90% of the maximum supply of 21 million.

Does circulating supply increase crypto?

The term circulating supply refers to the number of cryptocurrency coins or tokens that are publicly available and circulating in the market. The circulating supply of a cryptocurrency can increase or decrease over time.