Despite the anonymous nature of cryptocurrencies, the IRS may still have ways of tracking your crypto activity. For example, if you trade on a crypto exchange that provides reporting through Form 1099-B, Proceeds from Broker and Barter Exchange Transactions, they’ll provide a reporting of these trades to the IRS.

Can crypto mining be traced?

Mining and Bitcoin Circulation Bitcoin mining ensures that blocks of transactions are created and stacked in the right order in a way that can be traced and proven mathematically.

How to report crypto mining on taxes?

You need to report your crypto mining income to the IRS as part of your annual tax return. You report your income from mining on Form Schedule 1 (1040), or Form Schedule C (1040) if you’re self-employed or running a mining business.

Should I make an LLC for crypto mining?

Is an LLC good for a bitcoin mining business? Yes. An LLC will give you personal liability protection against potential business risks as well as give your company more tax options and credibility. It’s relatively inexpensive and simple to form and maintain an LLC when compared to the benefits provided.

Do I have to report mined crypto?

If you mine cryptocurrency You need to report this even if you don’t receive a 1099 form as the IRS considers this taxable income and is likely subject to self-employment tax in addition to income tax.

How much of crypto is used for illegal activity?

Can the government track crypto?

A fundamental characteristic of blockchain technology is transparency, meaning that anyone, including the government, can observe all cryptocurrency transactions conducted via that blockchain. Bitcoin transactions are publicly accessible because of the transparent nature of blockchain technology.

How much is crypto mining taxed?

Is crypto mining a hobby or business?

In short: If you’re trying out small-scale crypto mining on your personal computer, you should treat it as a hobby for tax purposes. On the other hand, if you own your own rack server and rely on the income, you should treat it as a business and write off some of your crypto mining taxes.

Can I write off crypto mining equipment?

In most cases, the cost of your mining equipment can be written off as a deduction in the year of purchase through Section 179. If the cost of your mining equipment you are deducting through Section 179 exceeds $2.6 million, you can deduct the cost of your equipment yearly through depreciation.

Can the IRS track Metamask?

Metamask does not have to send any information to the IRS because Metamask is an ETH wallet, and the IRS cannot keep track of Metamask.

Can the IRS audit cryptocurrency?

The IRS may have been slow to audit returns over the past couple of years, but the IRS has stepped up its enforcement of cryptocurrency transactions.

Is mined crypto taxable?

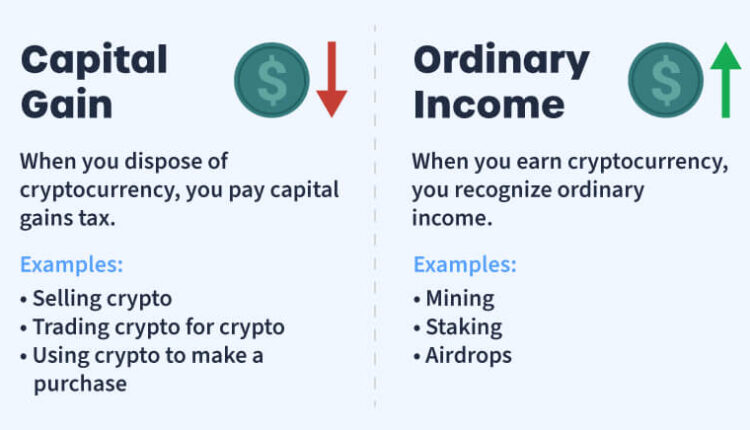

Mining cryptocurrency is a taxable event and must be reported to the IRS at the fair market value of the mined coins at the time they are received and is also a taxable event when the mined cryptocurrencies are sold/disposed.

Can the IRS track crypto mining Reddit?

Yes – the IRS can track crypto. Here’s how the IRS knows about your crypto: All major crypto exchanges must now complete KYC (Know Your Customer) checks.

Can TurboTax handle crypto mining?

If a bitcoin miner is self-employed, gross earnings minus allowable tax deductions are also subject to the self-employment tax. Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered.

Can the IRS track crypto mining Reddit?

Yes – the IRS can track crypto. Here’s how the IRS knows about your crypto: All major crypto exchanges must now complete KYC (Know Your Customer) checks.

Do you have to report crypto under $600?

If you earn $600 or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via IRS Form 1099-MISC (you’ll also receive a copy for your tax return).

Which cryptocurrency is untraceable?

The Most Untraceable Cryptocurrencies With such a long list of anonymous cryptocurrency currencies, Monero is without a doubt the greatest one. Monero offers a variety of cutting-edge cryptography methods to achieve true anonymity.

Do drug dealers use crypto?

Federal data indicate that virtual currencies—for example cryptocurrencies—are increasingly being used in illegal activities, such as human and drug trafficking. The use of virtual currencies has added to the challenges federal law enforcement face when trying to prevent and discover these crimes.

How big is crypto crime?

It concluded that one-quarter of bitcoin users are involved in illegal activity, and that the $76 billion in illicit payments involving bitcoin represented 46% of the currency’s total transactions.

What happens if you dont report crypto?

If you don’t report taxable crypto activity and face an IRS audit, you may incur interest, penalties, or even criminal charges. It may be considered tax evasion or fraud, said David Canedo, a Milwaukee-based CPA and tax specialist product manager at Accointing, a crypto tracking and tax reporting tool.