CBDC is managed on a digital ledger (which can be a blockchain or not), expediting and increasing the security of payments between banks, institutions, and individuals.

Will CBDC run on blockchain?

Their “Project Hamilton” Phase 1 executive summary notes that they found “a distributed ledger operating under the jurisdiction of different actors was not needed to achieve our goals.” In plain English they said that no blockchain is needed to implement a CBDC.

Will CBDC be built on Ethereum?

The Norges Bank, Norway’s central bank, has announced that Norway’s central bank digital currency (CBDC) prototype infrastructure is based on Ethereum technology.

What technology will CBDC use?

Consumers around the world are flocking to cryptocurrencies, ushering in a more decentralized era in global finance. Governments are taking note and are rushing to develop central bank digital currencies (CBDCs)—digital forms of fiat currencies built on blockchain technologies.

Is China CBDC based on blockchain?

Unlike Bitcoin and other cryptocurrencies, e-CNY does not operate through a blockchain-based decentralized ledger; rather, it is a centralized operation, issued and supervised by the PBOC.

Will CBDC run on blockchain?

Their “Project Hamilton” Phase 1 executive summary notes that they found “a distributed ledger operating under the jurisdiction of different actors was not needed to achieve our goals.” In plain English they said that no blockchain is needed to implement a CBDC.

Which blockchain does CBDC use?

Most widely used consortium blockchain in CBDC are Ethereum, Corda, Hyperledger Fabric and Quorum. The main application scenarios of these projects include inner-bank payments, inter-bank payments, cross-border payments and settlements.

Will CBDC end cryptocurrency?

CBDCs and other type of cryptoassets will invariably be introduced to the marketplace, and may actually challenge bitcoin and other earlier versions of crypto for market leadership. That said, there is no reason to think that CBDCs will lead to bitcoin becoming obsolete.

Are CBDC decentralized?

CBDCs are not cryptocurrencies, even if built on blockchain. They are centralized — controlled by central banks — while crypto is famously decentralized.

How can central banks use blockchain?

CBDC or tokenized central bank money leverages the decentralized and secure advantages of blockchain. Enabling peer-to-peer transactions, CBDC offer a more resilient payment infrastructure, reduce transaction costs, enhance information sharing capabilities and facilitate data reconciliation.

How is CBDC different from digital money?

Explaining the difference between CBDC and money in digital form, RBI said, “A CBDC would differ from existing digital money available to the public because a CBDC would be a liability of the Reserve Bank, and not of a commercial bank.”

Is CBDC a crypto?

In layman’s terms, a CBDC is simply digital fiat, whereas cryptocurrencies are digital assets on a decentralised network. The Reserve Bank of India has defined CBDC as a legal tender issued by a central bank in a digital form.

Will CBDC replace cash?

2. Will a U.S. CBDC replace cash or paper currency? The Federal Reserve is committed to ensuring the continued safety and availability of cash and is considering a CBDC as a means to expand safe payment options, not to reduce or replace them.

What is hybrid CBDC?

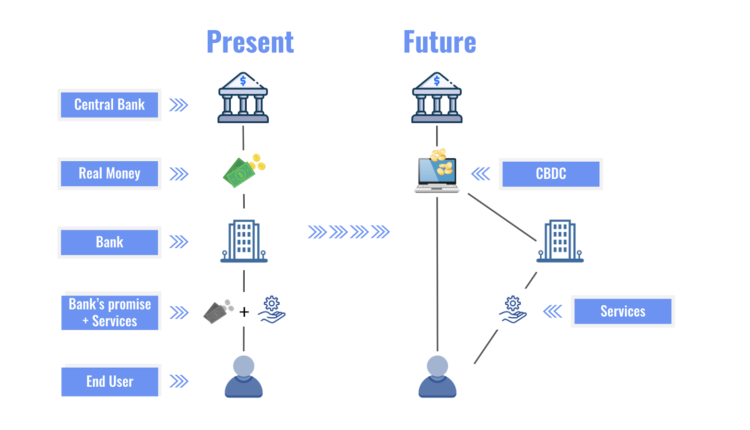

The “hybrid CBDC” model (bottom panel), is an intermediate solution providing for direct claims on the central bank while allowing intermediaries to handle payments.

What is China’s new cryptocurrency called?

The digital Yuan is China’s electronic currency. Also known as e-CNY or e-RMB or e-yuan, this currency stands in direct competition with cryptocurrencies, corporate payment systems, and mobile payment apps. Learn more about what it is and how it works.

Does the US have a CBDC?

A United States central bank digital currency (CBDC) would be a digital form of the U.S. dollar. While the U.S. has not yet decided whether it will pursue a CBDC, the U.S. has been closely examining the implications of, and options for, issuing a CBDC.

Is blockchain used in China?

China has made blockchain technology a strategic priority. Blockchain-based Service Network, or BSN, is part of its efforts to boost its capabilities in the sector. Chinese President Xi Jinping has declared that his country needs to “seize the opportunities” presented by blockchain technology.

How is CBDC different from cryptocurrency?

In layman’s terms, a CBDC is simply digital fiat, whereas cryptocurrencies are digital assets on a decentralised network. The Reserve Bank of India has defined CBDC as a legal tender issued by a central bank in a digital form.

How does CBDC affect crypto?

A CBDC is issued and regulated by a nation’s monetary authority or central bank. CBDCs promote financial inclusion and simplify the implementation of monetary and fiscal policy. As a centralized form of currency, they may not anonymize transactions as some cryptocurrencies do.

What is the difference between CBDC and electronic money?

CBDC is a new payment instrument that will either replace or coexist with fiat money to represent local currency values, whereas mobile money only represents the balances of payment instruments already in use, i.e., commercial bank fiat money.

Will CBDC run on blockchain?

Their “Project Hamilton” Phase 1 executive summary notes that they found “a distributed ledger operating under the jurisdiction of different actors was not needed to achieve our goals.” In plain English they said that no blockchain is needed to implement a CBDC.

What will replace money in the future?

Debit cards and electronic transfers are replacing physical money, leading to a system where governments, banks, businesses, and people transfer funds by having a third party change numbers on the equivalent of an electronic ledger.