Do you have to pay taxes on cryptocurrency in the US?

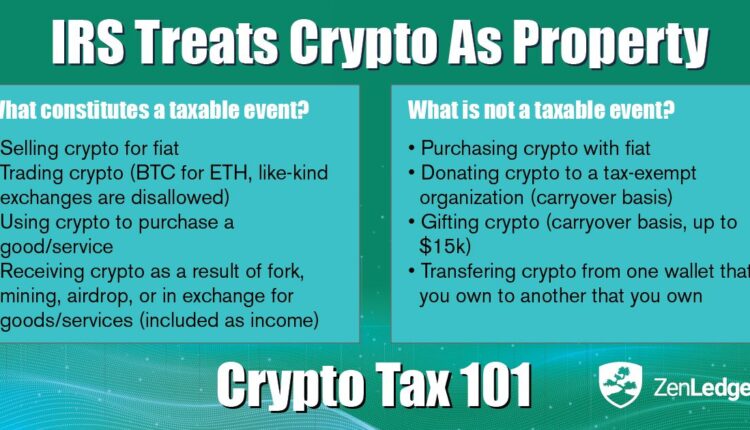

The IRS classifies cryptocurrency as a type of property, rather than a currency. If you receive Bitcoin as payment, you have to pay income taxes on its current value. If you sell a cryptocurrency for a profit, you’re taxed on the difference between your purchase price and the proceeds of the sale.

How does the IRS know if you have cryptocurrency?

One way the IRS can track cryptocurrency is through crypto exchanges or trading platforms. The transactions done on the exchanges/platforms are directly reported to the IRS. If your trading platform provides you with a Form 1099-B or 1099-K, the IRS knows about your crypto transactions.

How do I avoid crypto taxes?

Hold onto your crypto for the long term As long as you are holding cryptocurrency as an investment and it isn’t earning any income, you generally don’t owe taxes on cryptocurrency until you sell. You can avoid taxes altogether by not selling any in a given tax year.

How do I cash out crypto without paying taxes?

Can You Cash Out Bitcoins Tax-free in the U.S.? Some people can cash out Bitcoins tax-free in the U.S. Investors who do not exceed a $78,570 income can cash out at a 0% capital gains tax rate. You can also avoid taxes by investing Bitcoin in strategic investment accounts or modifying your citizenship.

What happens if you dont report crypto?

If you don’t report taxable crypto activity and face an IRS audit, you may incur interest, penalties, or even criminal charges. It may be considered tax evasion or fraud, said David Canedo, a Milwaukee-based CPA and tax specialist product manager at Accointing, a crypto tracking and tax reporting tool.

How much taxes do you pay on crypto?

Do you have to report crypto under $600?

If you earn $600 or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via IRS Form 1099-MISC (you’ll also receive a copy for your tax return).

Can you go to jail for not paying crypto taxes?

How much does IRS charge for cryptocurrency?

These rates range from 0-45%. Crypto trades, sales, or swaps are taxed as capital gains, Your exact rate depends on the length of time the asset was held and your overall income, but ranges between 0 and 37%. These trades are reported on Form 8949.

Will the IRS know if I don’t report cryptocurrency?

The simplest answer to this question is — yes! All of your bitcoin profits, gains, and exchanges must be reported to the IRS. If the IRS has reason to believe you have engaged in tax fraud, they may audit you. Years from now, investors may be hit with an inquiry and a tax bill they are unable to pay.

Will I get audited for not reporting crypto?

The IRS has crypto records from US exchanges If the IRS has your records from an exchange and you haven’t reported crypto on your tax returns—or if what you reported doesn’t match the IRS’s records—this could trigger a cryptocurrency audit or worse.

Do I have to report crypto to IRS if I lost money?

All disposals of cryptocurrency should be reported to the IRS, including those at a loss. Reporting losses may allow you to deducting them from your income or offset capital gains.

Will Coinbase send me a 1099?

Coinbase will issue an IRS form called 1099-MISC to report miscellaneous income rewards to customers that meet the following criteria: You’re a Coinbase customer AND. You’re a US person for tax purposes AND.

Does Coinbase report to IRS?

Yes. Coinbase reports your cryptocurrency transactions to the IRS before the start of tax filing season. As a Coinbase.com customer, you’ll receive a 1099 form if you pay US taxes and earn crypto gains over $600. Yes.

Can you write off crypto losses?

Can you write off crypto losses on your taxes? Yes. If you sell your cryptocurrency at a loss, you can offset your capital gains and $3000 of personal income for the year.

Which crypto does not report to IRS?

What triggers IRS audit crypto?

Crypto exchanges typically send 1099-B or 1099-K forms to clients that exceed certain transaction thresholds. Since the IRS receives copies of these, a failure to report income triggers the IRS’ Automated Under reporter Program.

Has anyone been audited for crypto?

Will I get caught not reporting crypto?

There’s a question about “virtual currency” on the front page of your tax return, making it clear you need to disclose crypto activity. If you don’t report transactions and face an IRS audit, you may be hit with interest, penalties or even criminal charges.

Do I pay taxes on crypto if I don’t sell?

Buying crypto on its own isn’t a taxable event. You can buy and hold cryptocurrency without any taxes, even if the value increases. There needs to be a taxable event first, such as selling the cryptocurrency. The IRS has been taking steps to ensure that crypto investors pay their taxes.

Is it illegal to not report crypto on taxes?

Intentionally failing to report cryptocurrency (or virtual currency as the IRS refers to it) is a crime – or can be multiple crimes depending on your actions or inactions. You could be sentenced to federal prison and/or ordered to pay high fines if you are convicted.