The maximum supply of a cryptocurrency refers to the maximum number of coins or tokens that will be ever created. This means that once the maximum supply is reached, there won’t be any new coins mined, minted or produced in any other way.

Is high circulating supply good for crypto?

For Bitcoin, the circulating supply is 19 million and for Ethereum the circulating supply is 121 million. The circulating supply is always a percentage of the total supply – the higher the percentage, the better.

Does Crypto supply affect price?

The more coins are in existence, the more demand there needs to be for a price to increase. A low supply means that the token (a share) is scarce and if in high demand, its price will likely rise. On the other hand, if the demand for a cryptocurrency is low but has a large supply, its price may drop.

What happens when a crypto token supply runs out?

Given the speculative nature of a lot of coins in this market, the supply of a coin can greatly affect its demand. In a perfect market, if the supply stops increasing, and the demand doesn’t—-the price would rise. Supply increasing with demand staying the same means that the price will decrease.

Can crypto max supply increase?

The circulating supply of a cryptocurrency can increase or decrease over time. For example, the circulating supply of Bitcoin will gradually increase until the max supply of 21 million coins is reached. Such a gradual increase is related to the process of mining that generates new coins every 10 minutes, on average.

Is high circulating supply good for crypto?

For Bitcoin, the circulating supply is 19 million and for Ethereum the circulating supply is 121 million. The circulating supply is always a percentage of the total supply – the higher the percentage, the better.

Does Crypto supply affect price?

The more coins are in existence, the more demand there needs to be for a price to increase. A low supply means that the token (a share) is scarce and if in high demand, its price will likely rise. On the other hand, if the demand for a cryptocurrency is low but has a large supply, its price may drop.

Why did Shiba circulating supply go up?

If you’re freaking out about circulating supply on the site increasing, it’s because some people are taking out from what they staked in ShibaSwap, so it goes back into circulation. This number can go up or down, if more people stake then circulating supply goes down again.

Which crypto has maximum supply?

Bitcoin is by far the world’s largest cryptocurrency by market cap, with a fixed maximum supply of 21 million.

Does higher supply mean lower price?

It’s a fundamental economic principle that when supply exceeds demand for a good or service, prices fall. When demand exceeds supply, prices tend to rise. There is an inverse relationship between the supply and prices of goods and services when demand is unchanged.

Why do some Cryptos have no max supply?

Because public demand determines USDC’s supply, it has no limit. Like the U.S dollar itself, it theoretically can be created an infinite number of times, and its ever-increasing popularity means that there’s no telling how many total coins will be in circulation.

Does Cardano have a limited supply?

Cardano has a limit of 45 billion coins minted. By keeping the amount of ADA down to 45 billion, the idea is to keep the coin liquid but not inflationary over the long term. Coins that do not have a limit are considered inflationary as the market can be flooded with supply.

What is the max supply of Cardano?

Cardano has a total limited supply of 45 billion tokens, and there is nearly 34 billion in circulation. That means there’s around 11 billion ADA tokens left in the market.

Is there an infinite supply of crypto?

There are many popular cryptocurrencies like bitcoin, ethereum, and Cardano, and they all have their different supply limits, while other cryptocurrencies have no limit, i.e. the supply of some is infinite.

What does high circulating supply mean?

Circulating supply is the supply in the law of supply and demand. If it is high and demand is low, prices of respective coins will depreciate. If supply is low and demand is high, then the coin prices will appreciate raising the value of the coins.

What does 100 circulating supply mean in crypto?

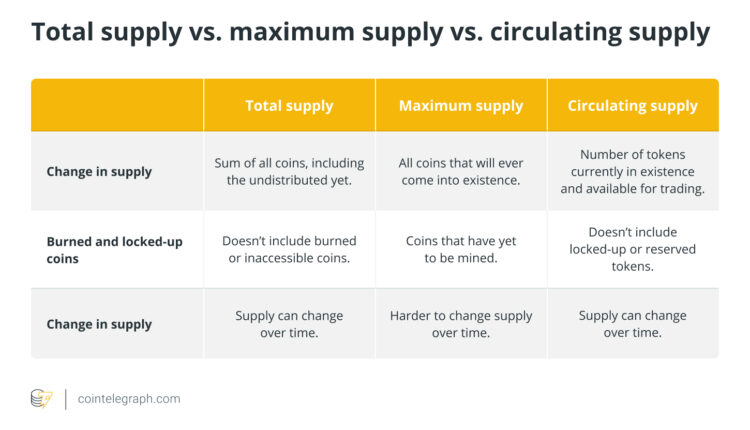

The circulating supply is the number of coins currently available for trade. The total supply is the number of coins that exist on the crypto markets at the present time but are not necessarily in circulation. It does not include coins that may be locked up or inaccessible to the public in some other way.

Is low supply good for crypto?

Having a low supply can generate high prices but only when demand is increasing as well. A low coin supply cryptocurrency with no demand is just a coin with a low supply.

How does circulation affect cryptocurrency?

Bitcoin’s market value is primarily affected by how many coins are in circulation and how much people are willing to pay. By design, the cryptocurrency is limited to 21 million coins—the closer the circulating supply gets to this limit, the higher prices are likely to climb.

Is high circulating supply good for crypto?

For Bitcoin, the circulating supply is 19 million and for Ethereum the circulating supply is 121 million. The circulating supply is always a percentage of the total supply – the higher the percentage, the better.

Does Crypto supply affect price?

The more coins are in existence, the more demand there needs to be for a price to increase. A low supply means that the token (a share) is scarce and if in high demand, its price will likely rise. On the other hand, if the demand for a cryptocurrency is low but has a large supply, its price may drop.

Will Shiba ever reach $1?

If Shiba Inu were ever to reach $1 per token, this would mean that the cryptocurrency network’s entire market value would be a whopping $549 trillion. That’s more than the amount of total global wealth, as estimated by consulting firm McKinsey & Co. Clearly, this aspirational price target is all but impossible.

Can Shiba Inu burn enough coins?

Shiba Burn Tracker made the estimation based on the rate of Shiba Inu burning in September, some 1.75 billion SHIB tokens destroyed. To take the burn wallet amount from 410.4 trillion to 900 trillion – or 90% of the initial supply – would take a further 25,269 years.